The United States is taking decisive steps to bolster Argentina’s fragile economy, unveiling plans for a new $20 billion financial facility aimed at private banks and sovereign wealth funds. This move comes shortly before Argentina’s highly anticipated midterm elections and follows a $20 billion US-Argentina currency swap, bringing the total potential financial support to $40 billion.

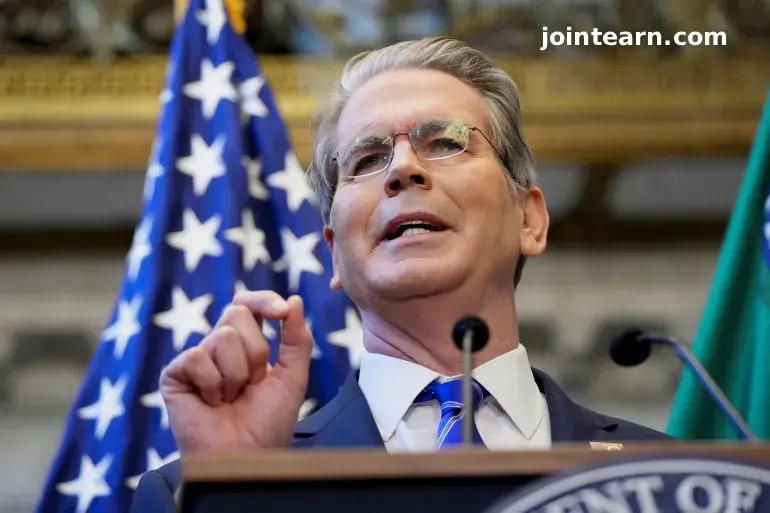

US Treasury Secretary Announces New Facility

US Treasury Secretary Scott Bessent revealed in a press briefing in Washington, DC, that he is coordinating efforts with the private sector to create a $20 billion facility specifically designed to support Argentina’s debt market.

“We are working on a $20 billion facility that would be adjacent to our swap line, involving private banks and sovereign wealth funds, and focused on the debt market,” Bessent said. He emphasized that this initiative builds on weeks of negotiations aimed at helping Argentina meet upcoming debt obligations.

This additional financial boost comes alongside the recent $20 billion currency swap arranged by the US Treasury to stabilize the Argentine peso, effectively doubling the total support to $40 billion. The announcement immediately sparked a rebound in Argentinian stock markets, reflecting investor confidence in continued US support.

Political Context: Midterm Elections and US Support

The move comes amid growing political uncertainty in Argentina. President Javier Milei, a right-wing populist who took office in 2023, implemented sweeping budget cuts to curb inflation and stabilize the economy. His policies, however, have sparked widespread protests and fierce opposition.

US President Donald Trump, who shares a right-leaning political ideology with Milei, has maintained strong relations with Argentina’s leader. During a White House meeting in 2024, Trump described Milei as his “favorite president,” and reaffirmed US support contingent on Milei’s continued political success.

“If he wins, we’re going to be very helpful,” Trump said, signaling that US economic assistance could be linked to the midterm election outcomes. However, Treasury Secretary Bessent later clarified that US financial backing is policy-specific rather than election-specific, ensuring continued support for Argentina as long as Milei’s administration pursues sound economic policies.

IMF Collaboration and Financial Outlook

The announcement coincided with the annual meetings of the International Monetary Fund (IMF) and World Bank in Washington, DC. The IMF, which already maintains a multibillion-dollar loan program with Buenos Aires, expressed support for the US bilateral initiatives.

President Milei has publicly expressed confidence that US financial assistance will remain in place while he pursues his libertarian economic agenda. In a broadcast interview, Milei emphasized his commitment to lowering taxes, deregulating industries, and promoting economic growth through pro-market policies.

“We continue to advance the ideas of freedom, so at least until 2027 we have that support assured,” Milei stated. He also indicated that a strong showing in the midterm elections would expand his legislative base, enabling him to push forward with his policy objectives.

Economic Implications

Analysts note that the combined $40 billion US support could provide a critical lifeline to Argentina’s struggling economy, helping to stabilize currency fluctuations, bolster investor confidence, and ensure that debt obligations are met on schedule. While political uncertainties remain, the strong US backing signals a commitment to long-term economic stability rather than short-term electoral considerations.

Treasury Secretary Bessent reinforced this view, stating, “It is not election-specific. It is policy-specific. As long as Argentina continues enacting good policy, they will have US support.”

With these financial mechanisms in place, Argentina may be better positioned to navigate upcoming economic challenges, sustain growth, and implement reforms designed to attract both domestic and international investment.

Leave a Reply