Wall Street gained early Wednesday as optimism about upcoming US-China trade talks lifted sentiment, but investors remained laser-focused on an upcoming speech by Federal Reserve Chair Jerome Powell amid ongoing inflation concerns.

📰 Stock Market Today: Early Gains, Lingering Caution

S&P 500 futures rose 0.6% Wednesday morning after the index fell 0.8% on Tuesday, bringing its year-to-date decline to 4.7%. While Asian markets welcomed news that the U.S. and China will begin formal negotiations on steep tariffs, the rally remained modest.

- China’s SSE Composite rose 0.8% (YTD: +2.46%)

- South Korea’s Kospi climbed 0.55%

- Japan’s Topix added 0.3%

- Stoxx Europe 600 fell 0.4%

- S&P futures advanced 0.6% premarket

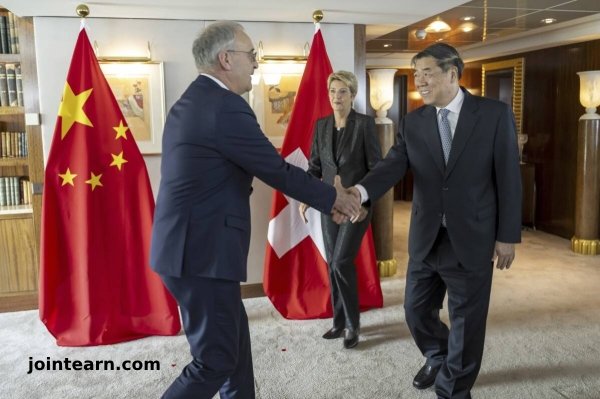

🔗 US-China Trade Talks 2025 Begin in Switzerland

Markets responded positively to news that U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will meet Chinese Vice Premier He Lifeng in Switzerland from May 9 to 12. The talks are a critical step after months of economic tension and mutual tariffs exceeding 100%.

Despite optimism, President Trump injected uncertainty, saying his administration doesn’t “have to sign deals,” dampening hopes for quick progress.

💬 Investor Focus Shifts to Powell and Fed Rate Outlook

While trade talks dominate headlines, investors are more closely watching today’s Federal Reserve interest rate announcement. Fed Chair Jerome Powell is expected to hold rates steady at 4.25%–4.50%, but markets are listening closely for clues about potential cuts later in the year.

According to Lazard’s Ronald Temple, there’s only a 3% chance of a rate cut today, but expectations rise to 48% by June.

However, Temple warns: “I continue to expect no Fed rate cuts in 2025 due to reacceleration of inflation driven by tariffs.” He estimates the current tariff level could add 175 basis points to core inflation by year-end.

💡 Tariffs Could Fuel Inflation, Say Economists

Goldman Sachs chief economist Jan Hatzius is also cautious. While he sees some improvement in the “mood music” between the U.S. and China, he expects tariffs to remain high—possibly easing from 160% to around 60%, but still historically elevated.

Hatzius also warns of potential new tariffs on pharmaceuticals, semiconductors, and entertainment, adding that the recession risk remains at 45% over the next 12 months.

📉 Other Market Highlights

- Palantir stock dropped 12% despite strong earnings, suggesting a “sell the news” reaction. Still up 44% YTD.

- European markets were mostly lower, tracking U.S. losses.