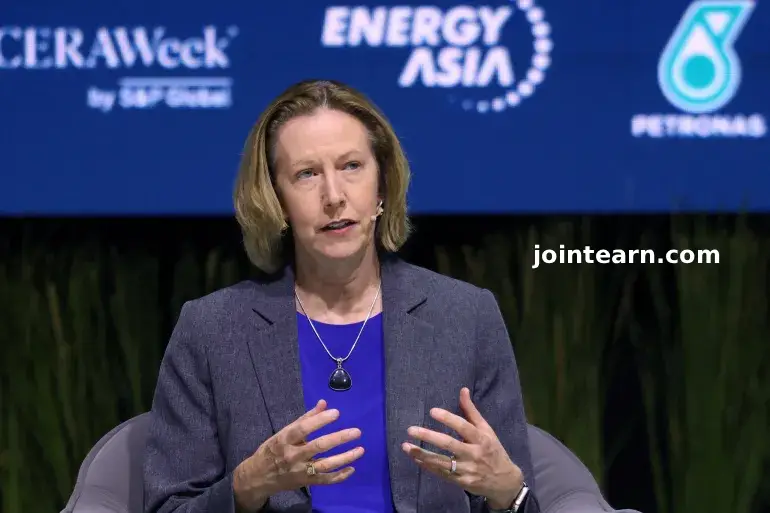

BP has appointed Meg O’Neill, the current CEO of Woodside Energy, as its next chief executive officer, marking the first external hire for the role in more than a century and the first woman to lead a top-five oil major. The move signals BP’s renewed focus on fossil fuels after a period of heavy investment in renewable energy projects.

O’Neill, a veteran of ExxonMobil, will assume the position in April 2026, following the abrupt departure of Murray Auchincloss, BP’s interim CEO. This leadership change is the second in just over two years as BP works to enhance profitability, operational efficiency, and shareholder returns, which have lagged behind competitors like Exxon.

Strategic Shift Toward Oil and Gas

Earlier this year, BP announced a major strategy overhaul, cutting billions in planned renewable energy investments and refocusing on core oil and gas operations. The company has pledged to divest $20 billion in assets by 2027, including the sale of its Castrol lubricants unit, while simultaneously reducing debt and operational costs.

“Progress has been made in recent years, but increased rigour and diligence are required to make the necessary transformative changes to maximise value for our shareholders,” said BP Chair Albert Manifold.

The strategy aligns with pressure from activist investors, including Elliott Investment Management, who have emphasized the need for cost reduction, asset divestment, and improved portfolio management.

Meg O’Neill’s Track Record

O’Neill, 55, from Boulder, Colorado, is the first openly gay woman to lead a FTSE 100 company. She has served as CEO of Woodside Energy since 2021, previously spending 23 years at ExxonMobil.

During her tenure at Woodside, O’Neill led a merger with BHP Group’s petroleum division, creating a top-10 global independent oil and gas producer valued at $40 billion, and doubled the company’s oil and gas output. She also spearheaded a major LNG project in Louisiana, positioning the company strategically in the US market.

BP has invested heavily in the US, spending over 40 percent of its $16.2 billion investment budget there last year and aims to reach 1 million barrels of oil equivalent per day in production by the end of the decade.

Market Reaction

News of O’Neill’s departure caused Woodside shares to drop by as much as 2.9 percent, while BP shares rose 0.3 percent, outperforming the broader European energy index. Analysts see the appointment as a positive step toward executing BP’s long-term profitability and portfolio strategy.

BP’s executive vice president, Carol Howle, will serve as interim CEO until O’Neill takes office. Auchincloss will remain as an advisor until December 2026.

BP’s Long-Term Outlook

BP has committed to maximizing oil and gas value while managing the transition from renewables. Under O’Neill, the company is expected to continue divesting non-core assets, reduce costs, and prioritize high-return energy projects, all while maintaining a presence in renewable ventures selectively.

“Should BP defer the sale of Castrol or cut share buybacks further? Analysts suggest yes, as part of a broader strategy to strengthen the balance sheet,” said RBC analyst Biraj Borkhataria.

Woodside has named Liz Westcott as acting CEO and plans to announce a permanent replacement in the first quarter of 2026.

Conclusion

The appointment of Meg O’Neill represents a historic moment for BP and the global oil industry. As the company pivots back toward fossil fuels, her experience in oil and gas expansion, mergers, and LNG projects positions BP to enhance profitability, shareholder value, and market competitiveness.

Leave a Reply