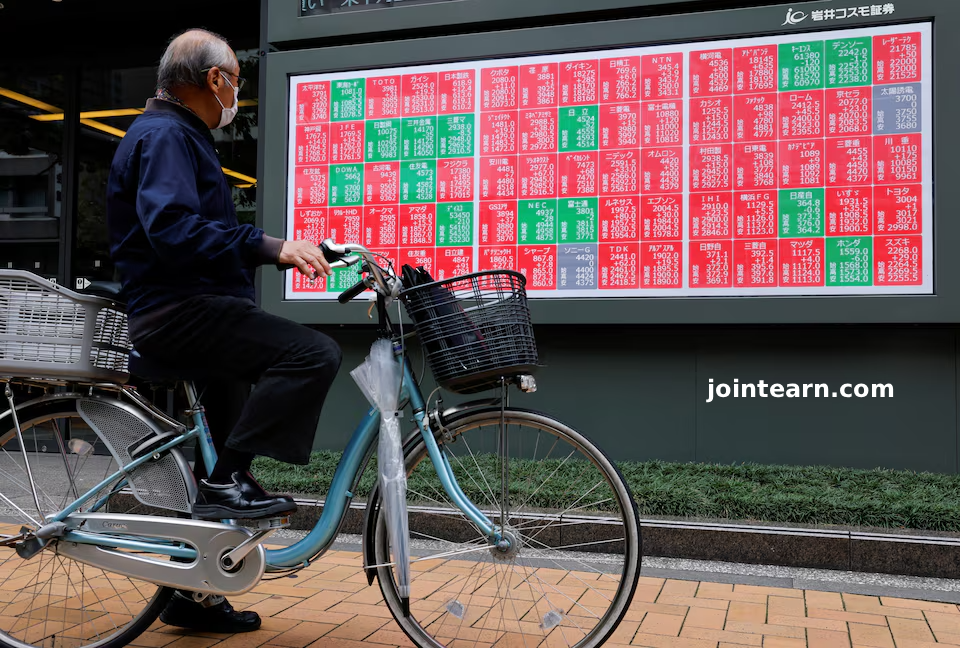

Foreign Investment in Japan Stocks Soars Ahead of Historic Prime Minister Vote

TOKYO, October 23, 2025 — Global investors are pouring billions into Japanese equities as political momentum builds behind Sanae Takaichi, poised to become Japan’s first female prime minister. Anticipation of her victory — and her promise of pro-growth, fiscally accommodative policies — has fueled a powerful rally in Tokyo’s markets, pushing the Nikkei 225 Index to an all-time high this week.

According to the Japanese Ministry of Finance, foreign investors purchased a net ¥752.6 billion ($4.99 billion) in Japanese stocks for the week ending October 18, marking the third consecutive week of inflows. This surge builds on an even larger ¥1.87 trillion net inflow from the previous week, underscoring renewed international confidence in Japan’s equity market.

Nikkei Hits Record High as Investors Bet on Takaichi’s Economic Agenda

The Nikkei 225 climbed to a record 49,945.95 points on Tuesday following Takaichi’s election. Investors are betting her administration will revive “Abenomics-style” stimulus policies, expanding fiscal spending and maintaining accommodative monetary conditions to jumpstart Japan’s economy amid sluggish growth and rising prices.

Takaichi, a hardline conservative and long-time ally of former Prime Minister Shinzo Abe, has pledged to prioritize wage growth, domestic investment, and business competitiveness — all of which appeal strongly to foreign institutional investors seeking exposure to Japan’s potential recovery cycle.

“Markets are pricing in a continuity of pro-growth policies and a decisive fiscal push,” said Hiroshi Tanaka, an economist at Tokyo Financial Research. “Foreign investors view this as a turning point for Japan’s structural reform and capital market resurgence.”

Massive 2025 Inflows Show Renewed Global Confidence

So far this year, foreign inflows into Japanese equities have reached ¥5.28 trillion ($35 billion) — more than double the ¥2.12 trillion recorded during the same period in 2024. This acceleration reflects Japan’s growing appeal as Western investors diversify away from China amid rising trade tensions and slower global growth.

The weaker yen, currently around ¥150.78 per U.S. dollar, has further enhanced the attractiveness of Japanese assets by making local stocks cheaper for overseas buyers.

Mixed Foreign Activity in Japan’s Bond Market

While equities drew strong inflows, the Japanese bond market saw mixed activity. Foreign investors sold a net ¥700 million in long-term bonds, marking their first net outflow since late September, even as short-term bills attracted ¥1.63 trillion in new foreign purchases.

Analysts say this reflects shifting expectations for the Bank of Japan’s monetary policy, as traders anticipate that the central bank will maintain ultra-low rates to support growth under Takaichi’s leadership.

Japanese Investors Turn Cautious on Overseas Assets

Conversely, Japanese investors have been trimming their exposure to foreign markets. During the same week, domestic investors sold ¥288.1 billion in overseas stocks — the fourth week of net sales in five weeks — and reduced holdings of foreign long-term bonds by ¥669.7 billion.

This trend highlights a homecoming of capital as Japan’s domestic outlook improves, and investors reallocate funds to take advantage of the local equity market’s strong performance.

Economic Outlook: Japan Reclaims the Global Investment Spotlight

With foreign inflows accelerating and policy continuity expected under Takaichi, analysts see Japan regaining its position as a global investment hotspot. The country’s combination of political stability, undervalued equities, and structural reform momentum makes it a compelling alternative for international funds amid geopolitical uncertainty.

“Japan is entering a new phase of optimism,” said Naoko Ito, head of Asia-Pacific strategy at Global Insight Partners. “Investors view Takaichi’s leadership as a signal that Japan is returning to a bold fiscal stance and long-term market growth.”

Key Market Highlights

- Foreign inflows: ¥752.6 billion in the week ended Oct. 18 (third straight week).

- Total 2025 inflows: ¥5.28 trillion — more than double 2024 levels.

- Nikkei 225: Record high of 49,945.95 points.

- Yen exchange rate: ¥150.78 per U.S. dollar.

- Foreign bonds: Net outflow of ¥700 million (long-term); inflow of ¥1.63 trillion (short-term).

- Domestic investor behavior: ¥288 billion in foreign stock sales, ¥669 billion in long-term bond disposals.

Leave a Reply