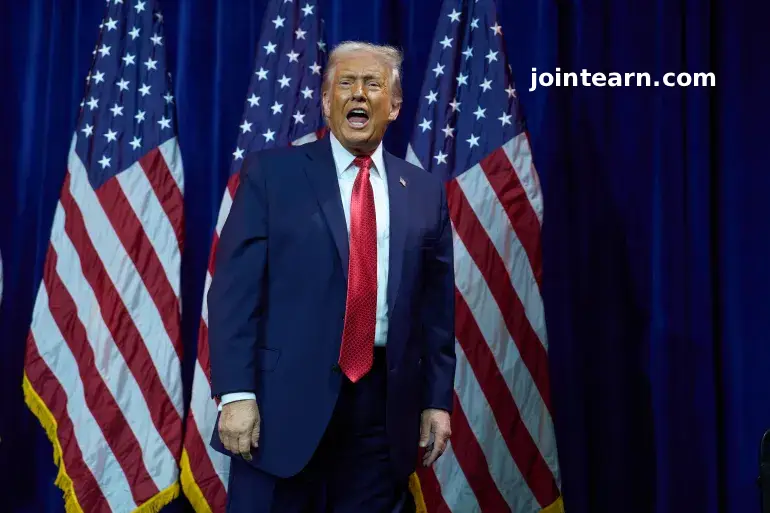

Washington, D.C. – January 7, 2026 – U.S. President Donald Trump has declared that Venezuela will transfer between 30 and 50 million barrels of oil, currently restricted under U.S. sanctions, to the United States. The move comes in the wake of the controversial abduction of Venezuelan President Nicolás Maduro and amid ongoing uncertainty surrounding U.S.-Venezuela relations.

Trump to Control Oil Revenues

President Trump stated that the oil will be sold at market prices, and that he would oversee the resulting revenues to ensure the funds benefit both the U.S. and the Venezuelan people. He directed Energy Secretary Chris Wright to implement the plan immediately, using storage ships to transport the oil directly to U.S. unloading docks.

“It will be taken by storage ships and brought directly to unloading docks in the United States,” Trump posted on his platform, Truth Social.

The announcement aligns with Trump’s broader pledge to regain control over Venezuela’s oil reserves and revive the country’s faltering energy sector. He also suggested that U.S. companies are prepared to invest billions in rebuilding Venezuela’s infrastructure and exploiting its reserves, which he claimed had been “stolen” from the U.S.—a statement not recognized under international law.

U.S. Oil Companies Prepare for Discussions

Major U.S. oil firms, including Chevron, ExxonMobil, and ConocoPhillips, have yet to comment publicly on Trump’s announcement. However, representatives from these companies are reportedly scheduled to meet the president to discuss opportunities in Venezuela. Chevron remains the only major U.S. operator currently producing in Venezuela, with output at approximately 150,000 barrels per day.

Experts note that the potential influx of 30 to 50 million barrels represents a modest addition to global oil supply, given worldwide consumption exceeds 100 million barrels per day. The U.S. alone produces roughly 14 million barrels per day.

“Thirty to 50 million barrels over what time frame? That’ll be key to assessing the significance of this,” said Mark Finley, an energy expert at the Baker Institute in Houston.

Scott Montgomery, a global energy analyst at the University of Washington, added that Trump’s comments regarding controlling revenues increase uncertainty over how the funds might be used.

“There’s not much precedent for this kind of control of foreign oil revenue by a sitting U.S. president,” Montgomery said.

Challenges in Restoring Venezuela’s Oil Industry

Venezuela once ranked among the top oil producers globally, but years of underinvestment, mismanagement, corruption, and U.S. sanctions have left the country producing less than 1% of global supply. Estimates suggest that restoring Venezuela’s production to two million barrels per day—roughly half of its 1990s peak—would require around $110 billion in investment, according to consultancy Rystad Energy.

“A significant amount of upfront scientific and engineering work must be done to assess the condition of productive reservoirs, which have changed over time,” said Montgomery.

Historical disputes also make U.S. companies wary. ExxonMobil and ConocoPhillips were awarded $1.6 billion and $8.7 billion, respectively, in arbitration following Hugo Chávez’s 2007 nationalization of oil fields—but Venezuela has not paid these awards.

Global Market Implications

Even if fully realized, the 50 million barrels would constitute a minor addition to global oil supply. Analysts note that the current glut in the global market and the high cost of restoring Venezuela’s decrepit infrastructure could limit U.S. investment incentives.

While Venezuela possesses the largest proven oil reserves in the world, the combination of political instability, logistical challenges, and historical asset seizures has left the nation’s energy sector in a fragile state.

Trump’s announcement signals his continued focus on Latin America’s energy resources, highlighting a strategy that combines military intervention, sanctions, and economic leverage to influence Venezuela’s oil production and revenue flows.

Leave a Reply