Soybean Imports Fall by 29% in April, Disrupting China’s Soymeal Supply Chain

China’s soybean imports plunged to the lowest level in a decade in April, as prolonged customs delays and late Brazilian shipments caused by harvest slowdowns and logistical issues disrupted trade. These disruptions are significantly impacting China’s oilseed processing industry and the country’s vast livestock sector.

Soybean Import Crisis in China

China’s total soybean imports for April reached just 6.08 million metric tons, marking a 29.1% decrease compared to April 2024. This is the lowest soybean import figure since 2015, according to data from China’s General Administration of Customs, as analyzed by Reuters.

The ongoing customs clearance delays, coupled with logistical setbacks from Brazil, are causing significant strain on China’s oilseed processing sector. The delays have forced soybean cargoes to take 20-25 days to move from ports to crushing plants, a substantial increase from the typical 7-10 days.

Impact on China’s Livestock and Crushing Industries

The slowdown in soybean processing is causing tight soymeal supplies, which are crucial for China’s massive livestock industry. By early May, numerous crushing plants, particularly in northern and northeastern China, were forced to either reduce output or halt operations entirely due to the backlog. This has led to some feed mills running out of stock, resulting in increased demand for costly spot cargoes.

Despite these challenges, soybean crushing operations are gradually recovering. However, concerns persist about the potential for continued port congestion if the delays continue.

Decline in U.S. Soybean Imports Amid Trade Tensions

U.S. soybean purchases by China have also significantly declined. According to the United States Department of Agriculture, as of May 1, net soybean sales to China for the 2024/25 marketing year were reported as zero.

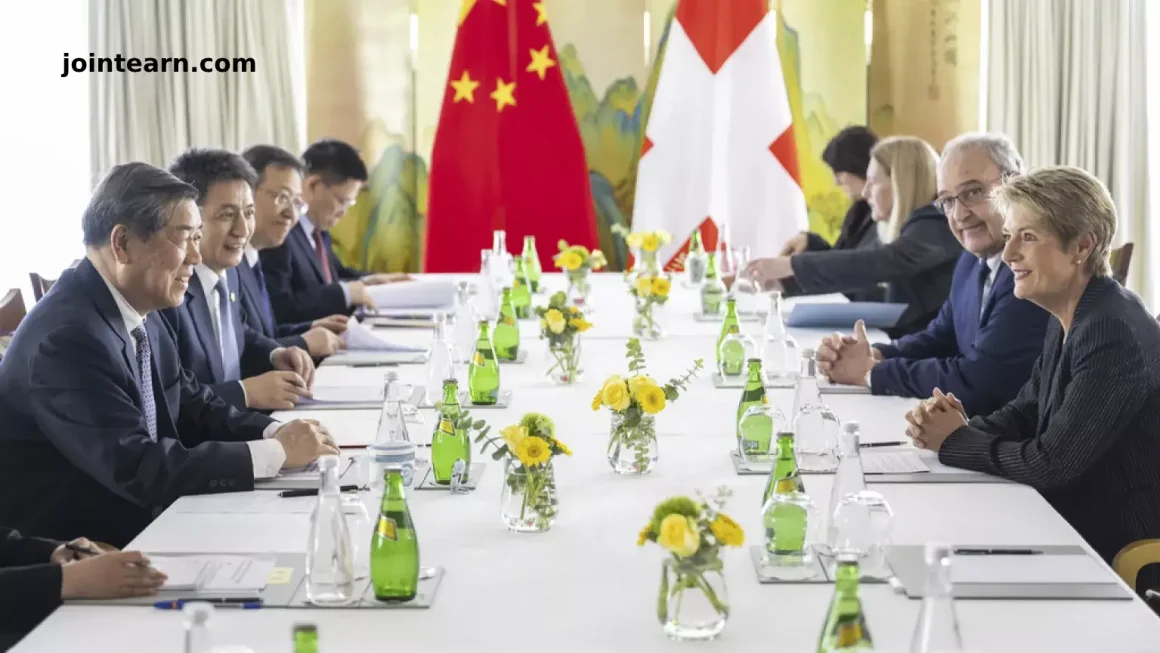

The continued imposition of China’s 125% retaliatory tariff on U.S. soybeans is expected to further hamper imports from the U.S. unless an agreement is reached between the two nations. The upcoming U.S.-China trade meeting in Switzerland could offer hope for resolving the trade war and potentially reducing tariffs.

Soybean Import Forecast: Rebound Expected in May and June

China’s soybean imports are expected to recover in May and June, with analysts predicting a sharp increase in imports to around 11 million tons per month. However, Brazil’s grain exporters association, Anec, has cautioned that total soybean exports could fall to 12.6 million tons in May, which may limit the quantity available for China.

Conclusion

China’s April soybean import slump highlights the ongoing challenges posed by customs delays, logistical issues, and the strained trade relationship with the United States. Despite these setbacks, analysts are hopeful for a recovery in imports in the coming months, provided logistical issues are resolved and global supply chains stabilize.