July 15, 2025 — China’s economy grew faster than expected in Q2, expanding 5.2% year-over-year, driven largely by surging exports and resilient manufacturing. This momentum puts Beijing’s full-year 5% growth target within reach, offering President Xi Jinping a critical opportunity to address the country’s deepening deflation crisis.

However, the strong headline growth masks underlying economic fragility. Nominal GDP — which accounts for price changes — rose just 3.9%, marking one of the weakest performances since 1993 outside the pandemic. Meanwhile, China’s GDP deflator remains in negative territory, extending the longest deflationary streak on record.

Deflation Dilemma Amid Strong Manufacturing

While exports contributed nearly a third of first-half growth, domestic consumption remains sluggish, weighed down by:

-

A prolonged property market downturn

-

Falling home prices

-

Low consumer confidence

-

Stagnant wages

This has created a dangerous feedback loop where falling prices discourage spending, reducing corporate profits and wage growth — and ultimately worsening the deflationary drag.

“Policymakers shouldn’t be lulled by solid GDP data,” said Raymond Yeung, chief economist for Greater China at ANZ. “Deflation is now the most urgent threat.”

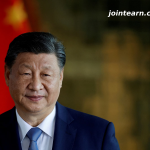

Policy Window for Xi Jinping

With growth currently stable, analysts say Xi Jinping has a rare chance to rein in industrial overcapacity and price wars without derailing the economy. Earlier this month, Chinese leaders acknowledged the problem of cutthroat competition driving down prices across sectors.

According to Standard Chartered’s Ding Shuang, curbing excessive competition now — by shutting unprofitable firms, encouraging mergers, and tightening antitrust rules — could improve pricing power and relieve long-term structural imbalances.

Challenges: Supply-Side Reforms Not So Simple

Many overcapacity issues lie in new industries, unlike past reforms which targeted outdated heavy industry. That makes it harder to identify which sectors or companies to scale back, said BNP Paribas economist Jacqueline Rong.

Additionally, any serious supply-side reform will require politically tough decisions — such as letting local firms fail — which may face pushback from provincial governments.

Muted Stimulus on the Demand Side

Despite the deflation concerns, China’s central bank is holding back on aggressive stimulus. The People’s Bank of China (PBOC) signaled it would monitor existing measures before taking further action.

Some analysts expect a modest rate cut of 10–20 basis points in Q4, while the government could expand fiscal efforts like:

-

¥500 billion ($70 billion) infrastructure investment program

-

Nationwide child subsidies

-

Mortgage rate cuts and urban renewal incentives

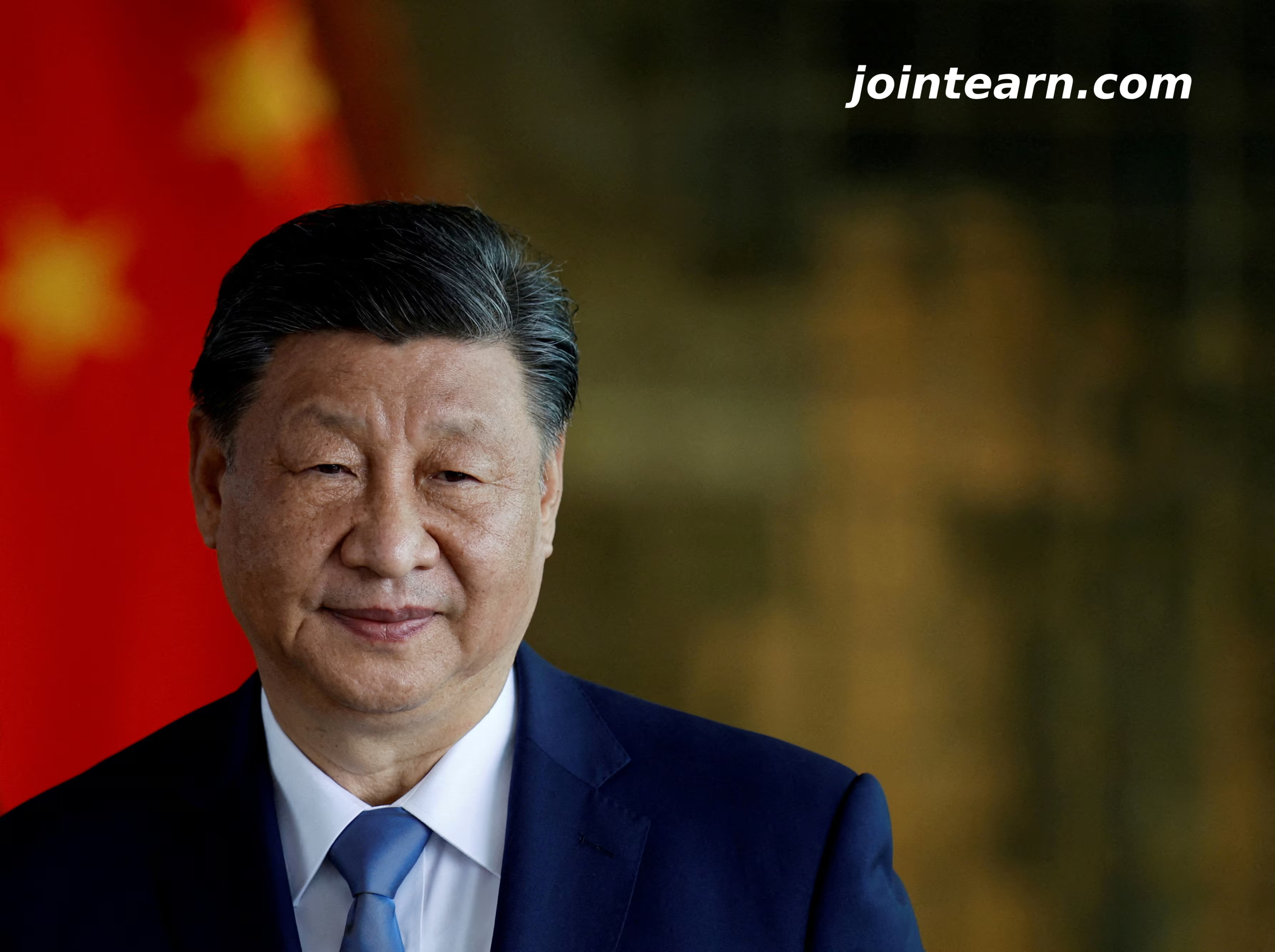

Still, economists like Larry Hu of Macquarie warn that Beijing may settle for hitting the 5% growth target without addressing deeper demand issues.

“Ideally, China would do more to boost domestic demand,” said Hu. “But they’ll likely just do enough to hit 5%.”

Bottom Line

While China’s strong export-led growth in Q2 has provided breathing room, it risks papering over persistent deflationary forces and weak domestic demand. Unless Xi Jinping’s administration seizes this window to restructure supply and stimulate consumption, the world’s second-largest economy could face prolonged disinflation or stagnation in the second half of 2025.