The Federal Government has commenced a structured process aimed at recovering defaulted housing loans granted to retired civil servants under various public sector housing initiatives, particularly those disbursed through the Federal Government Staff Housing Loans Board (FGSHLB). This move, according to authorities, is part of a broader fiscal strategy to improve accountability, reclaim public funds, and reinvest in affordable housing schemes for serving workers.

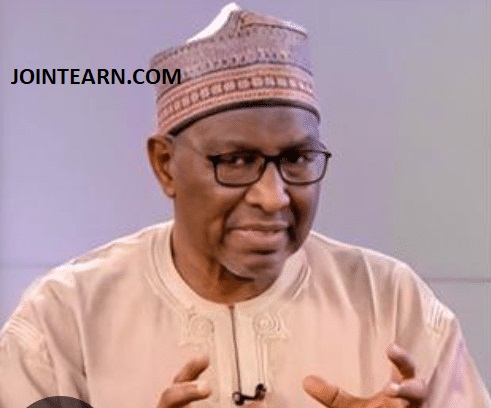

Speaking during a media briefing in Abuja on Friday, the Executive Secretary of the FGSHLB, Alhaji Ibrahim Mairiga, said the board is intensifying efforts to recover billions of naira in unpaid loans from retired beneficiaries who defaulted on the agreed repayment terms. The repayment plans, he noted, were often neglected after the retirees exited public service, leaving significant gaps in the board’s revolving housing fund.

Government Taking Action After Years of Lax Enforcement

According to Mairiga, the recovery initiative is long overdue and is being carried out in accordance with existing regulations. He revealed that several notices have already been sent to defaulters, while the board is collaborating with pension administrators, state governments, and the Office of the Head of Civil Service of the Federation to track affected retirees.

“We are not doing this out of vindictiveness. These loans were meant to be revolving so that others could benefit from them. Unfortunately, many retirees have failed to repay even a fraction of the loans they accessed while in service,” Mairiga said.

He added that the board is working with legal teams to explore all lawful means of recovery, including deductions from pension entitlements, out-of-court settlements, and in extreme cases, litigation.

Billions in Arrears Threaten Housing Loan Scheme

Reports from internal FGSHLB audits show that over ₦35 billion in housing loans remains unpaid. While some of the loans were granted under lenient conditions, many civil servants either ignored repayments or simply defaulted upon retirement, banking on the absence of a structured post-retirement repayment framework.

“This situation has undermined the sustainability of the housing loan scheme,” Mairiga emphasized. “We must ensure that the current generation of workers also has access to housing support, and that cannot happen if past beneficiaries do not fulfill their obligations.”

The board noted that it is currently reviewing all outstanding accounts to identify chronic defaulters and prioritize recoveries based on the size and age of the loans.

Civil Service Unions React Cautiously

In response to the federal government’s move, some civil service unions have reacted with cautious support, emphasizing the need for transparency and compassion in the recovery process. The Nigeria Union of Pensioners (NUP), while acknowledging that public funds must be accounted for, urged the government to consider the financial constraints faced by many retirees.

“Our members are not opposed to repayment, but many are struggling with high living costs and delayed pensions,” said Comrade Chuks Eze, a senior NUP official. “We urge the government to adopt flexible repayment terms and avoid blanket punitive measures.”

Eze also called on the government to investigate the circumstances under which some loans were granted, noting that several retirees may not have fully understood the terms at the time of approval or may have been misadvised.

Stakeholders Urge More Transparency

Policy experts and housing development stakeholders have described the government’s move as necessary but warned against heavy-handed implementation. They have called for greater transparency in the loan records and a formal audit that will be made public to build trust.

Dr. Ifeoma Okonkwo, a housing policy analyst, told reporters that many civil servants view government loans as entitlements rather than obligations.

“There’s a widespread perception that once you’re in government service, you can access these funds without long-term consequences. This mentality has to change. But for that to happen, there needs to be a consistent enforcement of loan agreements and public education about the revolving nature of housing support,” she said.

Okonkwo advised the FGSHLB to also digitize its records and publicly update its recovery efforts to demonstrate accountability and progress.

Retirement Benefits May Be Affected

One of the more controversial aspects of the recovery plan is the potential deduction of outstanding balances from retirees’ pension benefits. While legal under certain provisions of the Pension Reform Act and public service rules, this move has sparked debate among legal practitioners and rights advocates.

Human rights lawyer Barrister Ayo Balogun expressed concern that such deductions, if done without due process, could violate the constitutional rights of pensioners.

“The government must tread carefully. Recoveries must follow due process, and there must be mechanisms to allow affected individuals to contest inaccuracies or unfair deductions. We cannot punish retirees retroactively for systemic failures,” Balogun cautioned.

He urged the government to create a dispute resolution mechanism within the FGSHLB to handle complaints from retirees and ensure fair treatment.

Way Forward: Sustainable Housing for Civil Servants

While the recovery plan is ongoing, the FGSHLB says it remains committed to providing affordable housing options to serving civil servants. Alhaji Mairiga confirmed that the board is currently reviewing new applications and intends to expand its housing loan scheme under stricter terms.

“The objective is to make housing accessible to all civil servants, not just a privileged few,” he said. “With recovered funds, we can restart the cycle and give others a chance.”

The board also plans to launch a digital portal that will allow applicants and beneficiaries to track loan approvals, repayment schedules, and account balances, thereby improving transparency and accountability.

Conclusion

The Federal Government’s move to recover defaulted housing loans from retired civil servants marks a pivotal moment in public sector accountability and resource management. While the recovery plan faces criticism and concerns over fairness, it also represents a push toward a more sustainable and transparent housing support system for government workers.

The coming months will be crucial in determining how the government balances its need for fiscal discipline with its duty to treat retirees with dignity and respect.