Gold rises as investors anticipate the outcome of the highly anticipated US-China trade talks, which are set to begin this weekend.

Gold Advances Amid US-China Trade Tensions

Gold prices saw a significant rise at the end of a volatile week, as market participants weighed the potential outcomes of the upcoming US-China trade negotiations. Investors are particularly focused on how the talks between the world’s two largest economies could impact global markets and gold prices.

Gold Set for Weekly Gain

Bullion is on track to post a weekly gain of around 3%. The rise in gold prices follows US President Donald Trump’s proposal of an 80% tariff on Chinese goods, ahead of the trade negotiations slated to begin Saturday. Trump urged China to make more significant efforts to open their markets to US products.

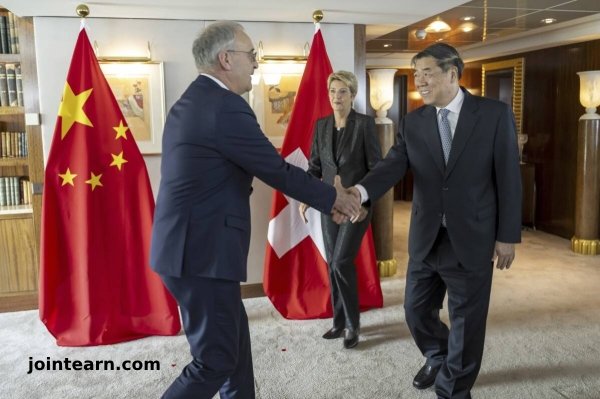

US-China Trade Talks in Geneva

The crucial trade talks, set to take place in Geneva, will be led by US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng. Sources close to the negotiations suggest that the US aims to reduce tariffs to below 60% as an initial step. There is a possibility that these tariff reductions could be implemented as early as next week if progress is made during the two-day discussions.

Gold’s Strong Rally Amid Trade War Concerns

The ongoing US-China trade war has been a key driver behind gold’s impressive 27% rally this year, with prices reaching a record high of $3,500 an ounce last month. While a de-escalation in trade tensions might reduce the demand for gold as a safe-haven asset, the yellow metal continues to be supported by strong central bank buying and increasing speculative activity from Chinese retail investors.

Gold and Other Precious Metals Rise

As of 10:56 a.m. in New York, spot gold surged by 0.9%, reaching $3,336.18 an ounce. The Bloomberg Dollar Spot Index dipped 0.3%. In addition to gold, other precious metals, including silver, platinum, and palladium, also saw gains.