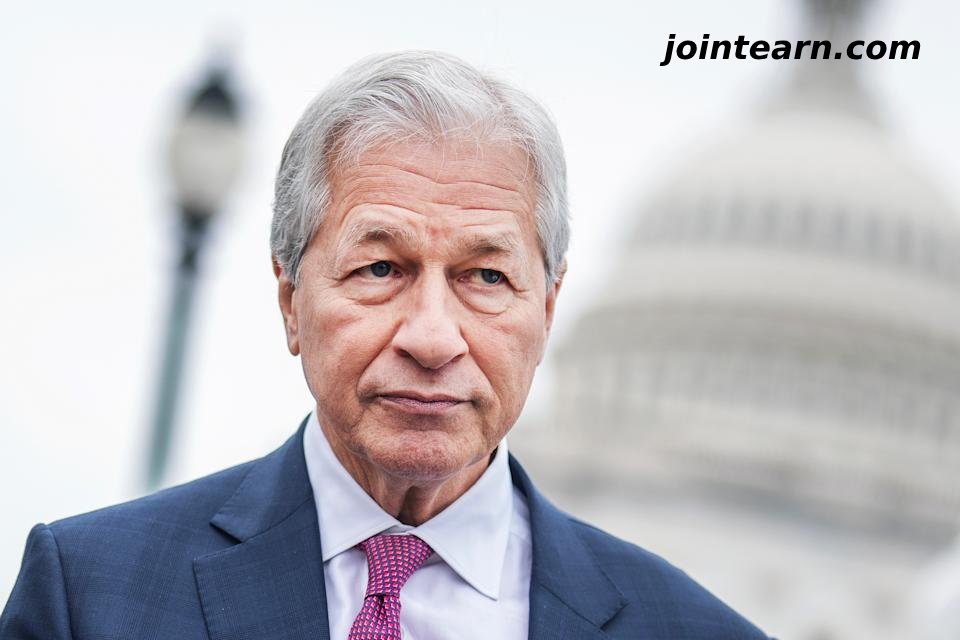

NEW YORK — July 15, 2025 — JPMorgan Chase CEO Jamie Dimon issued a pointed warning Tuesday against political interference in the U.S. Federal Reserve, saying that “playing around with the Fed” could lead to damaging unintended consequences for the economy.

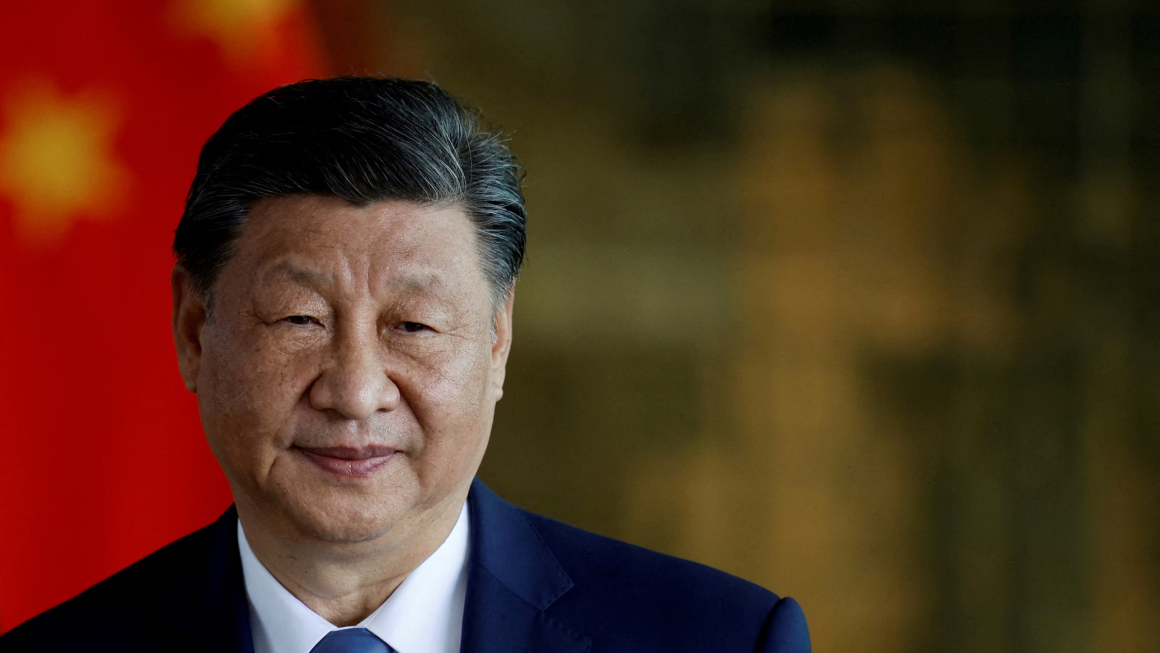

His comments come amid rising tensions in Washington, where President Donald Trump and top officials are publicly pressuring Fed Chair Jerome Powell to lower interest rates—and considering possible replacements ahead of Powell’s term expiration in May 2026.

“The independence of the Federal Reserve is absolutely critical,” Dimon told reporters following JPMorgan’s earnings release. “Interfering with the Fed can produce the absolute opposite of what may be hoped for.”

White House Eyes Powell Exit Amid Public Pressure

President Trump has repeatedly criticized Powell for maintaining what he sees as overly tight monetary policy. He has suggested replacing the Fed chair, although Treasury Secretary Scott Bessent said Tuesday that Trump “has said numerous times he’s not going to fire Jay Powell.”

However, the administration is now questioning Powell’s oversight of the Fed’s ongoing $2.5 billion headquarters renovation, potentially laying the groundwork for a formal case to remove him.

Kevin Hassett, head of the National Economic Council, said on Sunday that legal options to remove Powell early are being explored, though he emphasized that any move would require cause.

Bessent, widely viewed as a leading candidate to succeed Powell, also acknowledged the “formal process” of succession planning is underway and said he hopes Powell steps down from the Fed board entirely once his term as chair ends.

“There’s been a lot of talk of a shadow Fed chair causing confusion,” Bessent said. “It would be very confusing for the market.”

Markets Watching for Fed Disruption Risk

Dimon stressed the need for future Fed leadership to remain independent from political influence, saying:

“Let’s just see who the president picks. But I would say it is important they be independent.”

Other big bank executives downplayed the short-term risk to financial markets. Wells Fargo CFO Mike Santomassimo said Fed-related political noise hasn’t materially shifted market conditions, at least not yet.

Still, with inflation, employment, and rate expectations all closely tied to Fed credibility, any erosion in the central bank’s independence could rattle investors, especially as the 2026 election cycle intensifies.

Key Candidates to Replace Powell

If Powell steps down or is replaced, Trump is reportedly considering:

-

Scott Bessent – Treasury Secretary and former hedge fund CIO

-

Kevin Hassett – National Economic Council Director

-

Kevin Warsh – Former Fed Governor, hawkish voice from the Bush era

-

Christopher Waller – Current Fed Governor known for pragmatic approach

Markets are expected to react swiftly depending on the choice, with bond yields, equity valuations, and inflation expectations all potentially moving based on perceived central bank direction.

Bottom Line: As political tensions rise, Dimon’s warning underscores deep Wall Street concern about maintaining central bank independence. Any move to pressure or prematurely remove Powell could have far-reaching economic implications, especially amid a fragile recovery and geopolitical volatility.