Nvidia stock (NASDAQ: NVDA) continues to shine amid the artificial intelligence (AI) boom, surging over 800% since January 2023. The Trump administration’s recent move to rescind the Biden-era AI chip sales restrictions—known as the Framework for AI Diffusion—signals a potential upside catalyst for Nvidia investors.

Trump Administration Reverses AI Chip Export Controls

The U.S. Commerce Department under the Biden administration implemented the Framework for AI Diffusion, a set of export control rules limiting advanced semiconductor sales to several countries worldwide. This policy split countries into three tiers:

-

Tier 1: Close allies like Australia, Canada, Japan, and the UK with unlimited AI chip imports.

-

Tier 2: Countries with limited AI chip access, including India, Saudi Arabia, and Israel.

-

Tier 3: Nations like China, Iran, and Russia, banned from importing advanced AI chips.

Nvidia publicly criticized these restrictions, warning they would stifle AI innovation and global growth. Now, the Trump administration has scrapped the Framework, opting for a more flexible, country-by-country export negotiation approach.

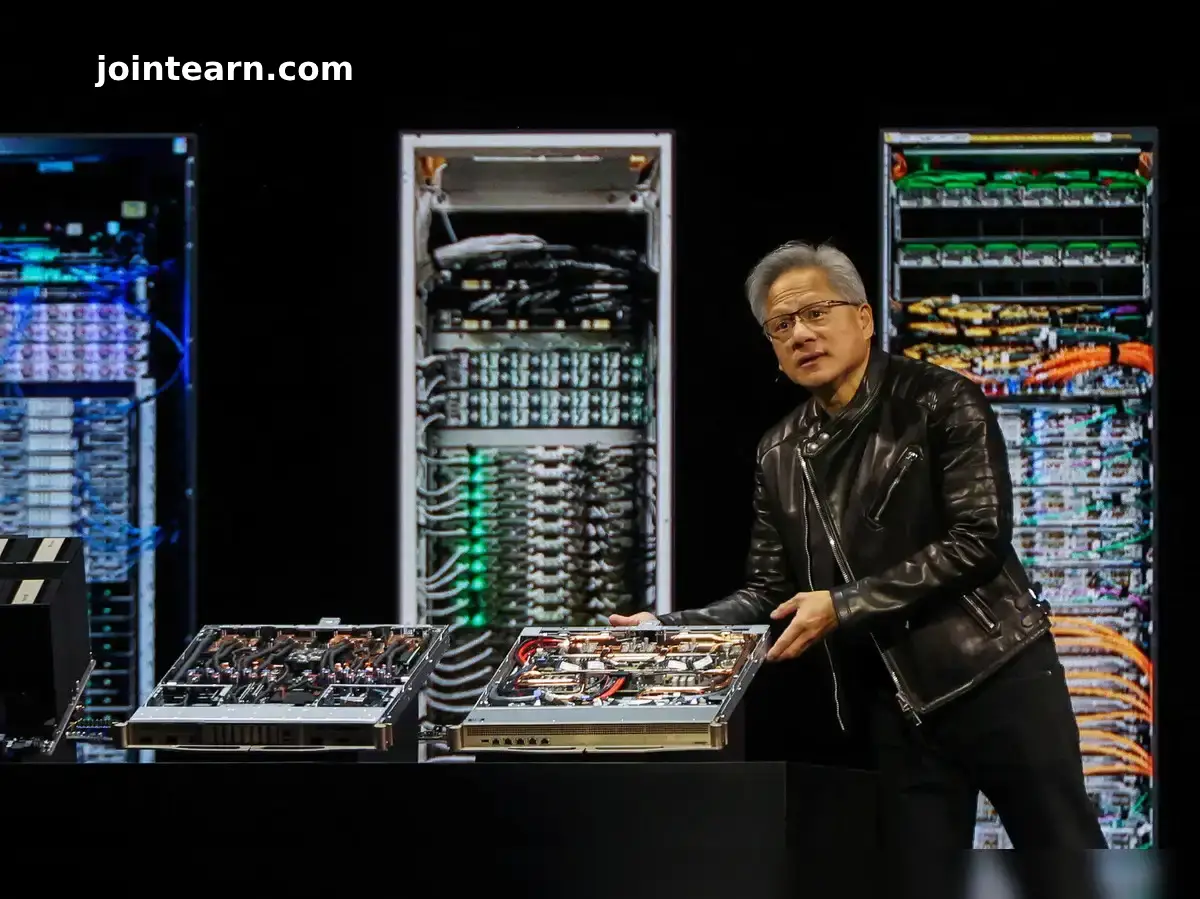

Nvidia Strikes Key AI Infrastructure Deals in Saudi Arabia

Following the rollback of export controls, Nvidia secured significant AI infrastructure deals with Saudi Arabian firms, including Humain and the Saudi Data & AI Authority (SDAIA). The partnership includes deploying 18,000 Nvidia Grace Blackwell superchips and Omniverse simulation software, boosting Nvidia’s footprint in the Middle East AI market—a region previously limited by export restrictions.

These deals highlight Nvidia’s expanding global presence and increasing GPU demand in emerging markets.

Nvidia Stock Outlook: Wall Street Remains Bullish

Despite ongoing challenges, such as limited GPU sales to China, Nvidia stock enjoys strong Wall Street support. Among 69 analysts covering Nvidia, 87% rate the stock as a buy, with a median price target of $160—an 18% upside from current levels around $135 per share.

Analysts forecast Nvidia’s adjusted earnings to rise 46% in the next year, making the current price-to-earnings ratio of 45 times justified by the company’s consistent earnings beat.

Why Investors Should Consider Nvidia Stock Now

With global AI adoption accelerating and geopolitical barriers easing, Nvidia stands poised for continued growth in the semiconductor and AI chip sectors. The recent Trump administration decision to lift export restrictions unlocks new markets, enhancing Nvidia’s long-term revenue potential.

For investors seeking exposure to AI-driven semiconductor innovation, Nvidia represents a compelling buy opportunity supported by strong fundamentals and optimistic analyst sentiment.