n a groundbreaking move that is set to redefine the banking landscape in Nigeria, Sterling Bank has announced the elimination of transfer fees on all local online transactions. This bold decision, effective immediately, positions Sterling Bank as the first major Nigerian bank to abolish these contentious charges, marking a significant shift towards more customer-centric banking practices.

Background and Rationale

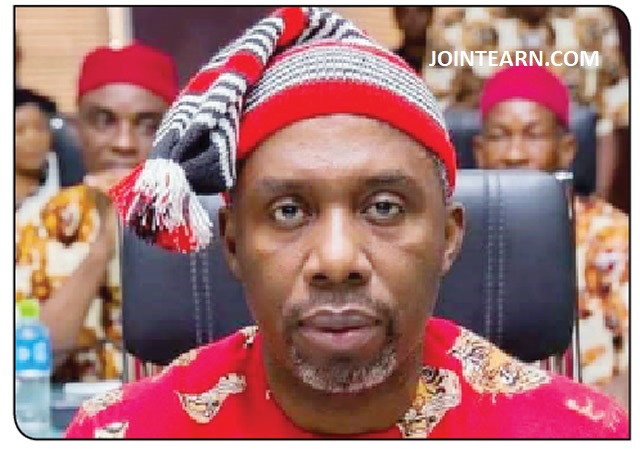

The decision to scrap transfer fees is part of Sterling Bank’s broader strategy to prioritize customer needs and redefine what it means to be a responsible and responsive financial institution. According to Obinna Ukachukwu, the bank’s Growth Executive for Consumer and Business Banking, this move is more than just a financial decision; it reflects a values-driven approach aimed at ensuring fair and inclusive banking. “We believe access to your own money shouldn’t come with a penalty,” Ukachukwu emphasized, highlighting the bank’s commitment to making banking fair and truly customer-focused123.

Impact on Customers

The elimination of transfer fees is expected to bring significant relief to individuals and small business owners who conduct frequent transactions. For those who rely heavily on digital banking, this policy change translates into substantial savings, allowing them to manage their finances more efficiently. The initiative is particularly beneficial in today’s digital age, where online transactions have become an integral part of daily life145.

Industry Reaction and Pressure

Sterling Bank’s move has sparked widespread public approval and placed pressure on other banks to follow suit. The bank has directly challenged industry giants such as Guaranty Trust Bank (GTCO), First Bank of Nigeria, Fidelity Bank, Access Bank, Stanbic IBTC, and United Bank for Africa (UBA) to implement similar measures. This call to action reflects Sterling Bank’s commitment to leading change in the banking sector and its belief in the need for a more customer-friendly approach across the industry59.

Broader Implications

The elimination of transfer fees by Sterling Bank could signal a broader shift in Nigeria’s banking landscape. As digital banking adoption continues to grow, customers are increasingly demanding cost-effective and transparent financial services. This move by Sterling Bank sets a new benchmark for customer-focused banking, potentially forcing other banks to reassess their fee structures to remain competitive37.

Historical Context

Sterling Bank has a history of pioneering customer-centric initiatives. During the COVID-19 pandemic, the bank stood out by providing supplementary payments to healthcare workers in public hospitals, demonstrating its commitment to supporting the community during challenging times. This latest move aligns with the bank’s tradition of redefining what it means to be a responsible financial institution2.

Global Perspective

While Sterling Bank’s decision is groundbreaking in the Nigerian context, it reflects a broader trend in the global banking sector towards more customer-friendly policies. In other regions, banks have also begun to waive certain fees in response to consumer demand for more transparent and cost-effective services. For instance, some banks in the United States offer accounts with no wire transfer fees or reduced fees for certain transactions6.

Conclusion

Sterling Bank’s decision to eliminate online transfer fees marks a significant milestone in Nigeria’s banking history. By prioritizing customer needs and challenging industry norms, Sterling Bank is not only redefining its own role in the financial sector but also setting a precedent for other banks to follow. As the banking landscape continues to evolve, initiatives like this will play a crucial role in shaping the future of financial services in Nigeria and beyond. With its bold move, Sterling Bank is poised to inspire a new wave of change that could benefit millions of Nigerians and redefine the banking experience for years to come.