President Donald Trump is preparing to unveil a significant tax hike on American importers, set to raise trillions of dollars over the next decade. This move could become the largest tax increase in the U.S. since World War II, with the burden ultimately falling on consumers.

Douglas Holtz-Eakin, a conservative economist and former director of the Congressional Budget Office, described the plan as an “extraordinary tax increase.”

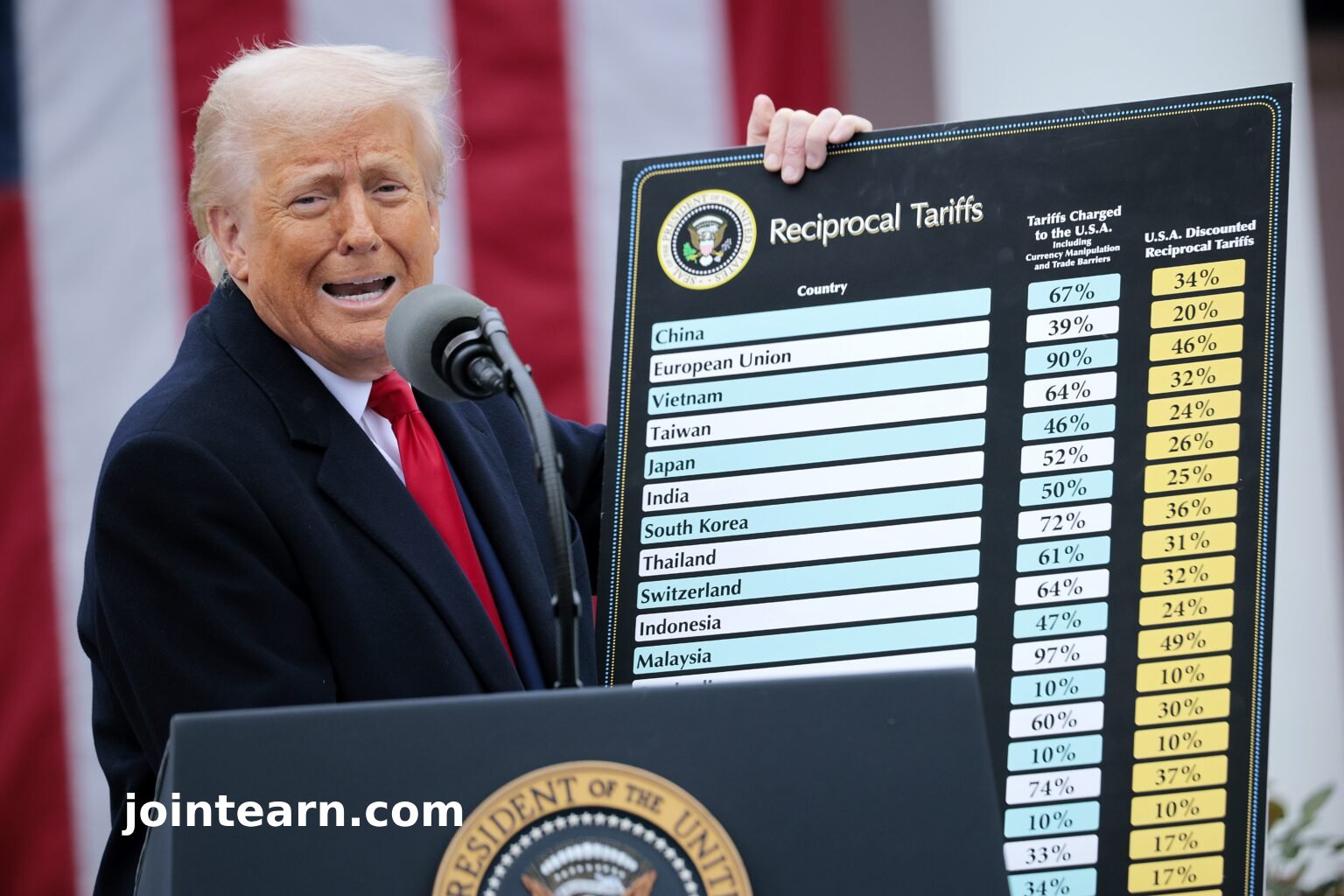

For weeks, Trump has been teasing his new import taxes as a form of “liberation,” promising the public that the new tariffs will reshape global trade. While White House officials have yet to disclose exact details, Trump’s recent remarks indicate that the tax increase will apply broadly to countries worldwide.

On Air Force One, Trump told reporters, “Essentially all of the countries” would be impacted by the new tariffs. Meanwhile, Peter Navarro, Trump’s trade adviser, revealed to Fox News that the tariffs are expected to generate $600 billion annually, amounting to $6 trillion over the next decade.

If accurate, this would rank as the third-largest tax increase in U.S. history, representing 2% of the nation’s GDP. Only the 1941 and 1942 tax hikes during World War II exceeded this, with increases of 2.2% and 5% of GDP, respectively, according to the Tax Foundation.

Erica York, Vice President of Federal Tax Policy at the Tax Foundation, emphasized the historic nature of the move, noting, “This would be the largest peacetime tax increase in U.S. history and the third-largest overall behind the WWII-era revenue acts.”

However, economists are skeptical about the projected revenue from these tariffs, suggesting that Trump’s estimates may be inflated. Harvard economist and former Obama adviser Jason Furman expressed doubts, stating, “I highly doubt that score is real,” predicting that American consumers will simply switch to cheaper alternatives if prices rise due to higher tariffs.

Despite these concerns, Trump has suggested the idea of eliminating the Internal Revenue Service (IRS) and replacing it with an “External Revenue Service” to reinforce the notion that foreign countries would bear the cost of these tariffs.

In reality, U.S. Customs already collects tariffs on imported goods. Once goods reach U.S. shores, importers – whether individuals, manufacturers, wholesalers, or retailers – are required to pay the tariffs before the goods are allowed entry. These costs are then passed on to consumers in the form of higher prices. As tariffs increase, consumers face higher costs.

Holtz-Eakin explained, “The only way the other country would pay the tariff is if they lowered the price of the good by the amount of the tariff. While this can happen initially, exporters rarely maintain those low prices for long.”

The broader economic consequences of Trump’s tariffs are a key concern. York warned that the proposed tax hikes could lead to significant harm for U.S. workers and businesses, potentially triggering a global trade war. “Trump’s tariffs will hurt American workers and businesses, significantly increase the tax burden on working-class households, and may spark a destructive tit-for-tat trade war,” she said. “This unnecessary economic pain will not lead to the promised economic benefits.”

As the President moves forward with his plans, the full impact of this unprecedented tariff strategy remains to be seen, with major implications for the U.S. economy and consumers worldwide.