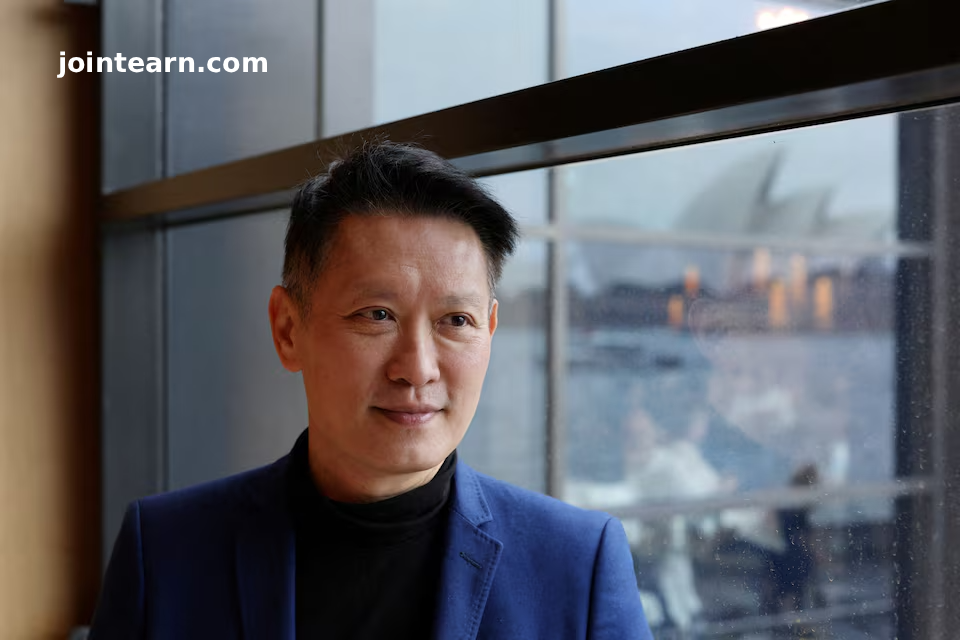

Sydney, Australia – Binance Chief Executive Richard Teng said on Friday that Bitcoin’s sharp decline over the past month reflects a broader trend of investor deleveraging and risk aversion seen across major asset classes.

Bitcoin, the world’s largest cryptocurrency by market capitalization, has tumbled 21.2% in November, extending losses to 23.2% over the past three months. These declines have raised the possibility that Bitcoin could finish the year below $90,000, though the digital asset is still trading at more than double its 2024 levels, buoyed by institutional investment adoption.

Bitcoin’s Recent Price Decline

The slump follows Bitcoin’s all-time peak above $126,000 in early October, driven by strong demand from institutional investors and favorable regulatory developments.

“As with any asset class, there are always different cycles and volatility. What you’re seeing is not only happening to crypto prices,” Teng said at a media roundtable in Sydney.

He added that the current environment reflects a risk-off market sentiment, with investors reducing leverage and taking profits after the sector’s strong performance over the past 18 months.

“Over the past 1.5 years, the crypto sector has performed very, very well, so it’s not unexpected that people do take profit,” Teng noted. “Any consolidation is actually healthy for the industry, for the industry to take a breather, find its feet.”

Broader Market Context

The cryptocurrency market is being affected by global market volatility, particularly concerns over AI-driven tech stock valuations. Even better-than-expected earnings from Nvidia (NVDA.O) have failed to fully ease investor worries about a potential tech bubble.

Teng emphasized that despite the recent selloff, Bitcoin’s long-term performance remains robust, underpinned by institutional adoption from firms such as BlackRock and growing global interest in digital assets.

Binance Leadership and Founder Update

Teng also addressed questions about the potential return of Binance founder Changpeng Zhao (CZ), following his pardon by U.S. President Donald Trump in October 2025.

“CZ has always been a controlling shareholder. As controlling shareholder he has more shareholder rights associated with that,” Teng said. “On a day-to-day basis, I work very closely with the board directors, which includes three independent directors and an independent chairman, so we continue to chart the future strategy of the company.”

Zhao, a Canadian citizen born in China, served nearly four months in U.S. prison last year and paid a $50 million fine after pleading guilty to violating U.S. money laundering laws. He was replaced as CEO by Teng in 2023.

Key Takeaways

- Bitcoin volatility: Declines in line with broader asset classes amid risk-off sentiment.

- Price drop: Bitcoin down 21.2% in November; Ether also under pressure.

- Institutional adoption: Bitcoin trading more than double 2024 levels due to firms like BlackRock.

- Market context: AI stock bubble and global market volatility impacting crypto sentiment.

- Binance leadership: CEO Richard Teng managing strategy; CZ’s return remains undecided.

Leave a Reply