The Trump administration has announced plans to resume wage garnishment for borrowers who have defaulted on their federal student loans, marking the first such action since the onset of the COVID-19 pandemic. Borrowers will begin receiving notices starting January 7, 2026, according to a spokesperson for the U.S. Department of Education.

How the Wage Garnishment Will Work

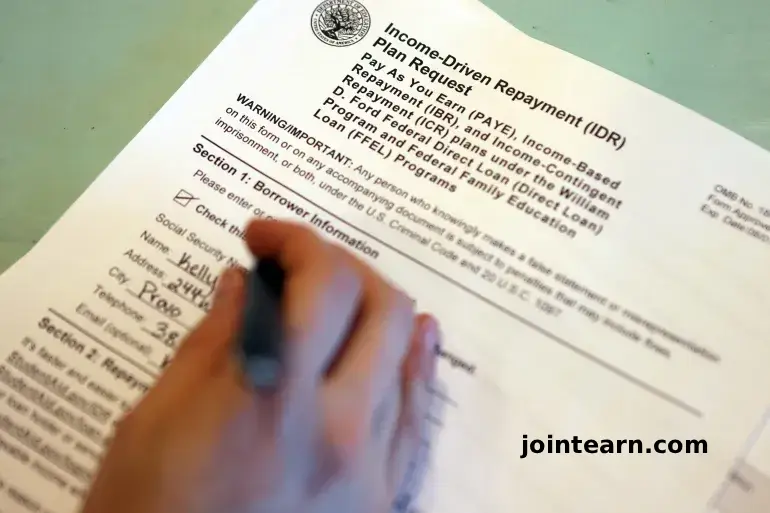

Under federal law, the government may garnish up to 15% of a borrower’s take-home pay, provided the individual is left with at least 30 times the federal minimum wage per week. Currently, the federal minimum wage remains $7.25 per hour, unchanged since 2009.

The Department of Education confirmed that collections are only pursued after borrowers receive adequate notice and opportunities to repay their loans. Wage garnishment is one of several collection methods, alongside deductions from tax refunds, Social Security benefits, and certain disability payments.

Who Will Be Affected

The initial phase of the program will impact approximately 1,000 borrowers, with the number expected to grow over time. The Department of Education did not disclose how borrowers were selected for the first round or the total number of individuals who may eventually face garnishments.

Approximately one in six American adults holds student loan debt, totaling around $1.6 trillion. As of April 2025, more than 5 million borrowers had not made a payment in at least a year, highlighting the scope of the student debt crisis.

Economic Context

The resumption of garnishments comes amid a cooling labor market and rising unemployment. According to the consulting firm Challenger, Gray & Christmas, over 1.1 million Americans lost jobs in 2025 as job growth slowed. Federal data shows mixed trends, with employment losses in October followed by modest gains in November, pushing the unemployment rate to 4.6%, the highest since 2021.

Experts and former officials have warned that the policy could place additional strain on struggling families. Julie Margetta Morgan, former deputy undersecretary at the Education Department under President Joe Biden, told Al Jazeera:

“Families are being forced to choose between paying their bills and putting food on the table. The Trump administration’s decision to begin garnishing wages takes even that meagre choice away from student loan borrowers who are living on the brink.”

Broader Implications

The move to resume wage garnishment underscores the broader challenges of student loan affordability in the United States. Many borrowers struggle to repay loans while covering basic living expenses, and economic pressures such as rising prices and job losses exacerbate the situation. Critics argue that garnishments may punish borrowers rather than address systemic issues in higher education financing.

Key Takeaways

- Wage garnishment resumes January 7, 2026 for some student loan defaulters.

- Initial impact: approximately 1,000 borrowers, with numbers growing over time.

- Government can garnish up to 15% of take-home pay.

- Broader economic pressures include rising unemployment and slowing job growth.

- Policy faces criticism for increasing financial strain on struggling families.

Leave a Reply