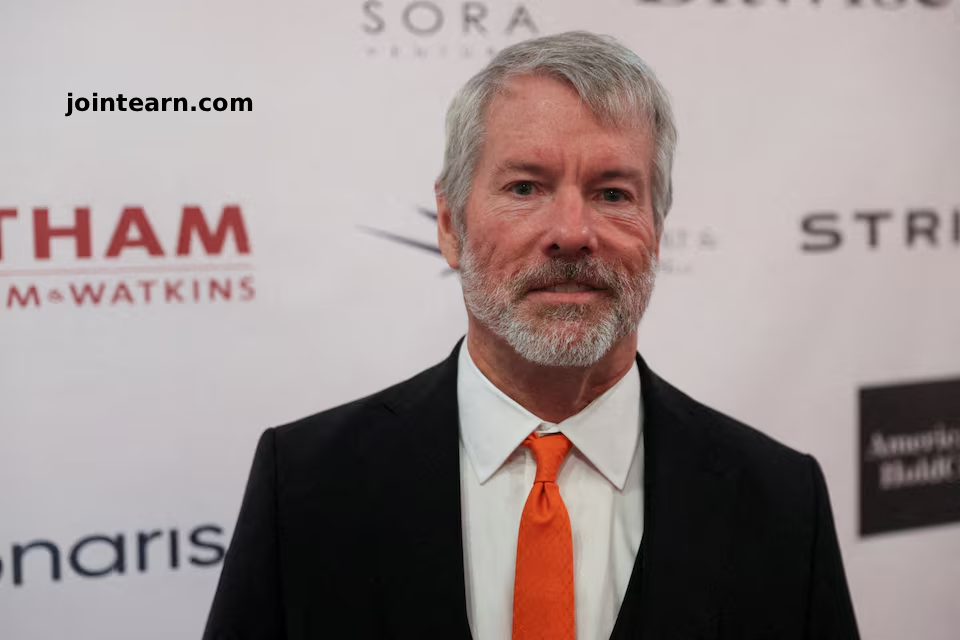

Shares of billionaire Michael Saylor’s Strategy (MSTR.O) jumped 6% in premarket trading on Wednesday, following MSCI’s decision to suspend plans to exclude crypto treasury firms from its global indexes. The move comes as debate continues over the proper classification of digital asset treasury companies (DATCOs) and their role in equity markets.

MSCI Postpones Crypto Treasury Exclusion

MSCI, a leading global index provider, had previously proposed removing companies with significant crypto holdings from its benchmarks, arguing that these firms resemble investment funds rather than traditional operating companies. This proposal had raised concerns that other major index providers could follow suit, potentially impacting the valuation and visibility of DATCOs in equity markets.

However, analysts at J.P. Morgan confirmed:

“For now, MSCI will maintain the current index treatment for DATCOs with digital asset holdings representing 50% or more of total assets.”

Mike O’Rourke, Chief Market Strategist at JonesTrading, added:

“MSCI intends to open a broader consultation on the treatment of non-operating companies generally. We suspect exclusion is postponed until later in the year.”

What Are Digital Asset Treasury Companies (DATCOs)?

DATCOs are companies that hold cryptocurrencies such as Bitcoin, Ethereum, and Solana as their primary treasury assets. These firms have surged in popularity since 2025, offering investors a proxy for direct exposure to crypto markets without purchasing tokens themselves.

Despite their growing appeal, the underlying digital assets remain highly volatile, making the stocks of these companies equally prone to swings. Accounting treatment for crypto holdings is also unsettled, with debates ongoing about whether DATCOs should be valued as operating companies or investment vehicles.

Strategy Leads the Crypto Treasury Trend

Strategy, originally known as MicroStrategy, pioneered the trend of corporate bitcoin accumulation in 2020. Its aggressive purchase of Bitcoin sparked interest among dozens of other companies to adopt crypto as a treasury asset.

While Strategy’s stock fell 47.5% in 2025 due to declining Bitcoin prices, the recent MSCI decision reignited investor optimism, leading to a notable pre-market surge of 6%. Analysts view this as a positive sign for other DATCOs in the market, highlighting that index treatment can significantly affect investor perception and stock performance.

Market Implications and Investor Outlook

The MSCI decision reflects a cautious approach toward crypto-related equities, allowing investors time to adjust to evolving regulations and accounting standards. Experts note that:

- Firms with more than 50% of assets in crypto remain eligible for index inclusion.

- Broader consultation on non-operating companies is expected, which could influence future index rules.

- Investor interest in DATCOs remains strong despite underlying token volatility.

As institutional adoption of digital assets continues, Strategy and other crypto treasury firms are likely to remain a focal point for investors seeking exposure to Bitcoin and other digital currencies via the stock market.

Leave a Reply