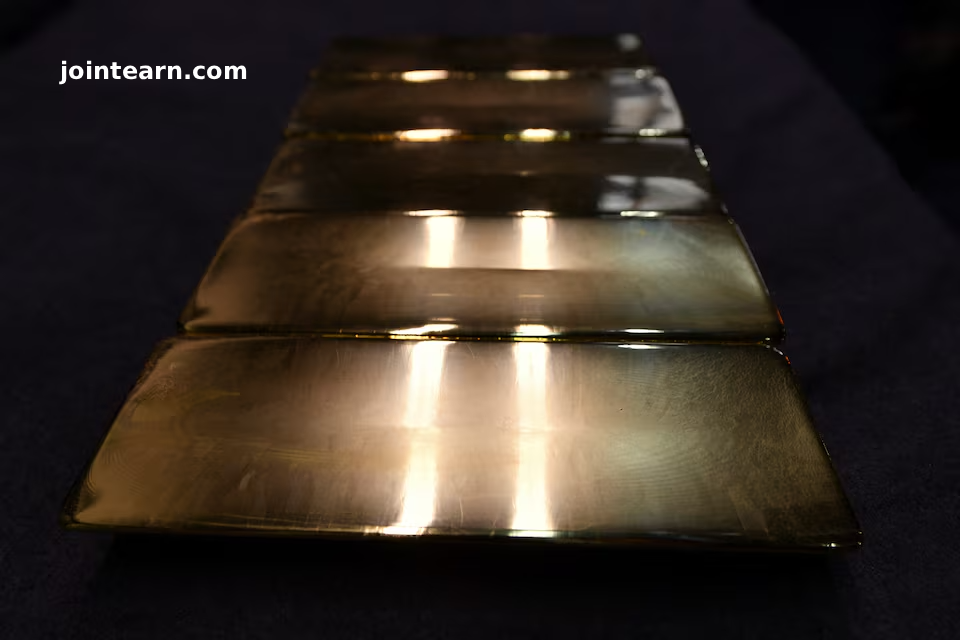

China’s net gold imports via Hong Kong fell sharply in October, declining approximately 64% from September, according to data released by the Hong Kong Census and Statistics Department. This slowdown highlights weakening demand from the world’s largest gold consumer and may influence global gold market trends.

October Gold Import Data via Hong Kong

In October, China’s net gold imports through Hong Kong totaled 8.02 metric tons, a steep drop from 22.047 tons in September. Total gold imports via Hong Kong were 30.08 tons, down 17% compared with 36.275 tons in the previous month.

Analysts note that the Hong Kong figures do not provide a full picture of China’s gold activity, as Shanghai and Beijing also serve as significant import hubs for gold.

Expert Insights on Weakening Demand

Ross Norman, an independent precious metals analyst, commented on the slowdown:

“What we’re really seeing here is a weakness in the Chinese demand while they have been firmly strong earlier in the year. Domestic demand is probably being met locally. So the market’s kind of looking after itself to some extent.”

The slowdown coincides with discounted bullion prices in China last month, where gold traded at discounts of about $48-$60 an ounce compared with the global benchmark spot price.

Impact of Policy and Market Factors

Several factors have contributed to the reduction in gold imports:

- Swiss Gold Exports: Swiss gold shipments to China plunged 93% to 2.1 tons in October as elevated global prices limited demand.

- Tax Policy Changes: On November 1, Beijing reduced the VAT exemption on gold purchased through the Shanghai Gold Exchange and Shanghai Futures Exchange, effectively raising costs for gold used in jewellery and industrial applications.

- Global Gold Prices: Spot gold reached a record high of $4,381.21 per ounce on October 20, driven by geopolitical tensions, economic concerns, easing U.S. monetary policy, and strong inflows into gold-backed exchange-traded funds (ETFs).

Despite the weaker imports, China’s central bank continued to increase gold reserves, marking the twelfth consecutive month of accumulation. Gold holdings rose from 74.06 million fine troy ounces in September to 74.09 million ounces in October.

Implications for Global Gold Markets

China’s declining imports may signal a temporary slowdown in consumer demand, especially for physical gold in jewellery and industrial use. However, central bank purchases indicate continued strategic accumulation, supporting long-term price stability.

Investors and analysts are closely monitoring:

- The influence of tax policy changes on domestic demand

- The impact of high gold prices on import volumes

- Potential shifts in global supply-demand dynamics, particularly in the wake of China’s central bank reserve accumulation

Conclusion

China’s October gold import slump via Hong Kong reflects a combination of market corrections, policy adjustments, and elevated global prices. While consumer demand appears subdued, the continued accumulation of gold by the central bank underlines China’s strategic commitment to strengthening reserves. These trends are likely to shape global gold markets heading into the end of 2025.

Leave a Reply