Germany Faces Deepening Semiconductor Supply Crunch, Warns Ifo Institute

BERLIN, Oct. 29, 2025 — Germany’s industrial sector is facing mounting pressure as semiconductor shortages and rare earth supply disruptions intensify, according to a new report released Wednesday by the Ifo Institute for Economic Research.

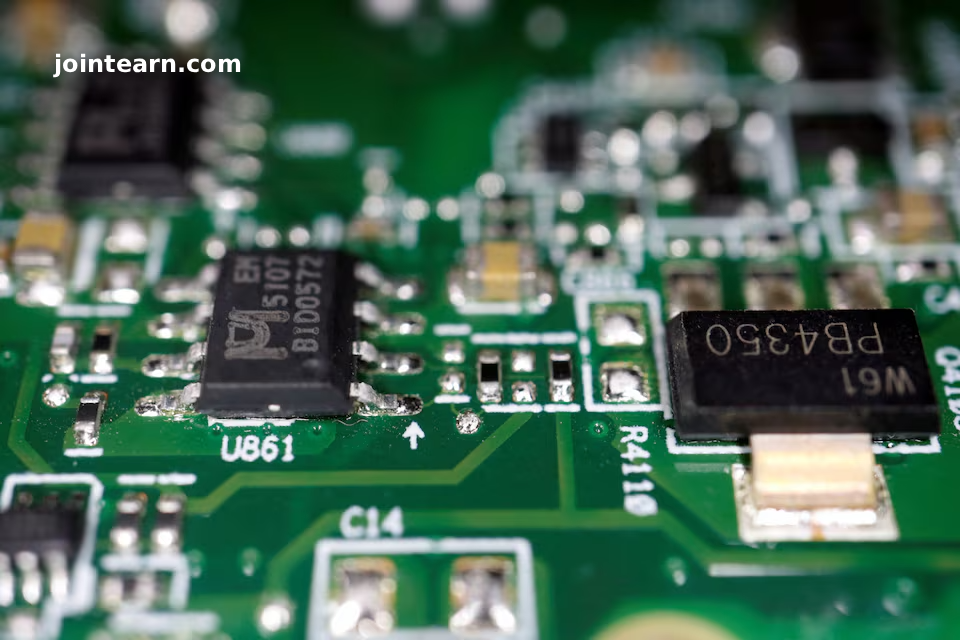

The think tank said that shortages of materials essential for electronic and optical product manufacturers worsened significantly in October, largely due to tightened global trade restrictions on rare earth components — the vital elements used in the production of microchips, sensors, and advanced digital technologies.

Rare Earth Controls Hit German Manufacturing

Rare earths are crucial to the semiconductor and high-tech industries, and China remains the world’s leading supplier. However, new export controls from Beijing have exacerbated the global supply crunch, creating a ripple effect across Europe’s industrial heartlands.

According to the Ifo survey, 10.4% of German companies in the electronic and optical sectors reported supply bottlenecks in October — a sharp rise from 7.0% in July and 3.8% in April.

“The control mechanisms and trade restrictions for rare earths are taking their toll,” said Klaus Wohlrabe, head of surveys at the Ifo Institute. “If this trend continues and worsens, it will have a negative impact on overall economic growth.”

By comparison, only 5.5% of all German manufacturers reported supply chain problems across the broader industrial landscape, highlighting that semiconductor-dependent sectors are bearing the brunt of the crisis.

The Semiconductor Strain: Global Causes and Local Consequences

The global semiconductor shortage—first triggered by pandemic-era disruptions and now deepened by geopolitical tensions—has already slowed production across Europe’s key industries, from automotive manufacturing to industrial automation and consumer electronics.

Germany’s export-driven economy is particularly exposed. Companies in the automotive, robotics, and medical technology sectors rely heavily on advanced chips and precision sensors, most of which require rare earth materials such as neodymium, dysprosium, and terbium.

Trade analysts warn that China’s move to tighten export controls on these elements is a direct response to Western restrictions on semiconductor technology exports to Chinese firms. This tit-for-tat escalation has deepened concerns about supply chain security and energy transition technologies, including electric vehicles and renewable energy systems, both of which depend heavily on rare earth components.

European Push to Reduce Dependency

In response, European policymakers are ramping up efforts to diversify rare earth supply chains and reduce dependency on China. The European Critical Raw Materials Act, passed earlier this year, aims to strengthen domestic sourcing, recycling, and strategic stockpiling of key minerals.

However, experts caution that such initiatives will take years to bear fruit. Developing new mining operations and refining facilities across Europe involves environmental challenges, high costs, and regulatory hurdles.

“Boosting domestic production is essential, but it’s not an immediate fix,” said a Berlin-based trade economist. “Germany’s manufacturers must brace for continued shortages well into 2026.”

Outlook: Risks to Growth and Innovation

The Ifo Institute warned that sustained supply shortages could slow Germany’s industrial recovery and undermine innovation in key sectors like AI, automation, and renewable energy technologies.

With the global race for semiconductor independence accelerating, Germany faces the dual challenge of securing access to raw materials and maintaining competitiveness in high-tech production.

“The chip shortage is no longer just an electronics problem—it’s an economic one,” said Wohlrabe. “Without stable access to rare earths and semiconductors, Germany’s position as a manufacturing powerhouse is at risk.”

Conclusion

As the chip shortage in Germany intensifies, the latest Ifo data underscores the urgent need for strategic supply chain diversification and technological resilience. With trade tensions escalating and rare earth supplies tightening, Europe’s largest economy must balance short-term industrial pressures with long-term sustainability goals — or risk falling behind in the global technology race.

Leave a Reply