The Federal Government defended Nigeria’s rising public debt stock, currently at about N152 trillion, insisting that the increase largely reflects exchange rate adjustments and improved transparency, rather than reckless new borrowing.

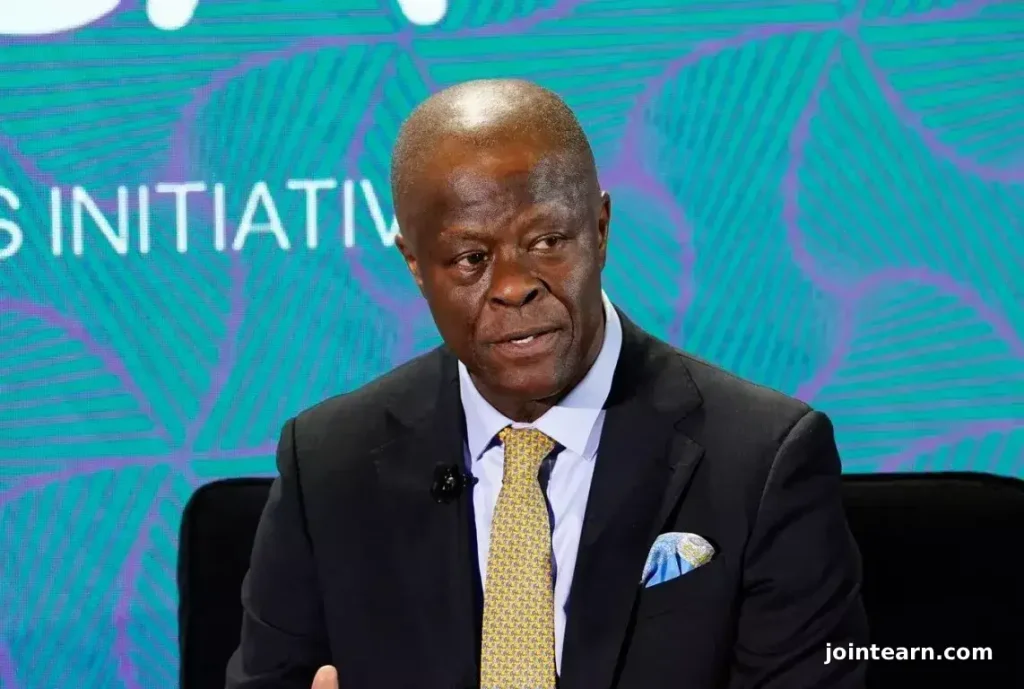

Speaking at the Nigerian Economic Summit Group (NESG) 2026 Macroeconomic Outlook in Lagos, Coordinating Minister of the Economy and Minister of Finance, Wale Edun, explained that the Tinubu administration prioritised openness and fiscal discipline.

“Nigeria’s total public debt stands at N152 trillion, just over $100 billion. Importantly, N30 trillion previously recorded as Ways and Means has now been transparently recognised, while exchange rate adjustments account for much of the remaining increase, not new borrowing,” Edun said.

Fiscal Management and Reforms

Edun emphasised that the government has met all statutory obligations, including salaries, pensions, and debt service, despite fiscal pressures.

He noted that fiscal federalism reforms have strengthened states’ finances, with several running budget surpluses, enabling increased spending on health, education, and public services.

“After more than two years of implementing politically challenging reforms, Nigeria is now at the threshold of consolidation. But consolidation demands resolve, discipline, and policy consistency,” he added.

Edun also highlighted efforts to remove economic distortions such as preferential foreign exchange access, fuel subsidies, and rent-seeking opportunities, creating a level playing field driven by productivity and innovation.

Positive Global Signals

The Finance Minister said Nigeria’s reforms have improved investor confidence:

- Exiting the FATF grey list

- Removal from the EU high-risk third-country list

- Positive responses from credit rating agencies

He projected economic growth of 4.68% in 2026, with inflation averaging 16.5%, and the naira exchange rate pegged at ₦1,400 to $1.

“The 2026 Budget, titled ‘Budget of Consolidation, Renewed Resilience and Shared Prosperity,’ reflects President Tinubu’s commitment to translating macroeconomic gains into food, electricity, housing, and employment,” he said.

Analysts Weigh In

Several experts offered reactions to Edun’s statements:

- Oluropo Dada (CIS): While transparency reforms are welcome, new domestic borrowing remains critical to sustain government operations.

- David Adonri (High Cap Securities): Legacy debt is not the sole driver; continued borrowing could exacerbate Nigeria’s debt trap.

- Olatunde Amolegbe (CIS): Debt-to-GDP ratio at 36% indicates sustainability is manageable, but caution is warranted when examining debt-to-revenue ratios.

- Clifford Egbomeade: While recognition of off-balance-sheet obligations enhances transparency, fiscal sustainability will depend on effective debt servicing and revenue mobilisation.

Key Takeaways

- N152 trillion debt includes N30 trillion in previously unrecorded Ways and Means and N49 trillion from foreign debt revaluation.

- Transparency improvements enhance credibility and investor confidence.

- Fiscal sustainability requires continued discipline, revenue growth, and careful debt management.

Leave a Reply