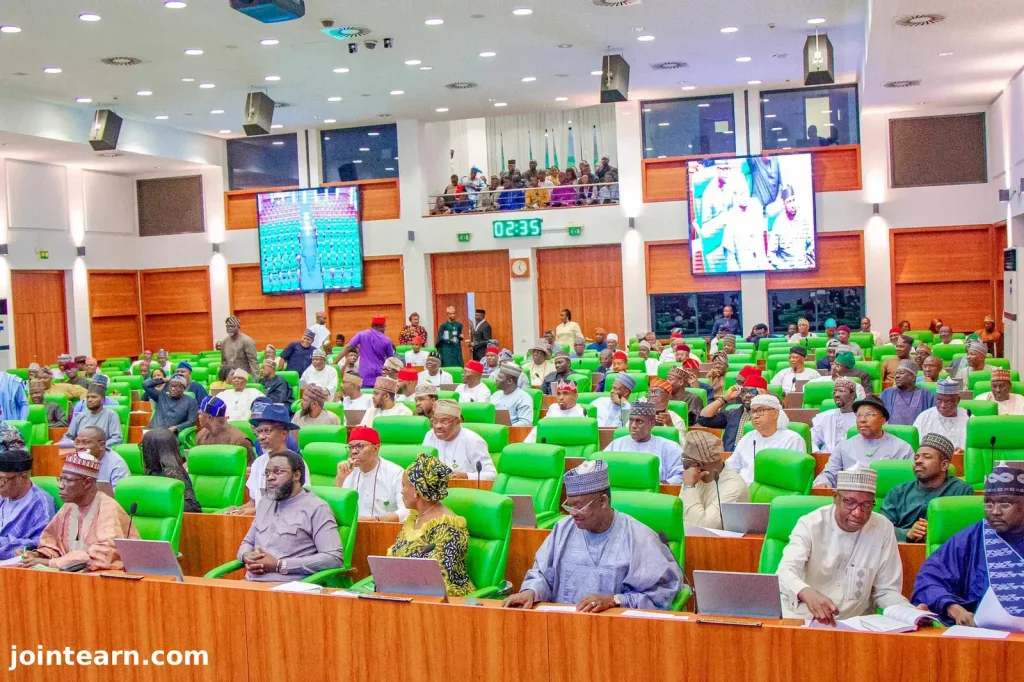

The House of Representatives Ad-hoc Committee investigating the economic, regulatory, and security risks of cryptocurrency adoption and Point-of-Sale (POS) operations has raised concerns over a worsening fraud crisis threatening Nigeria’s financial system.

At a resumed hearing on Monday, Hon. Olufemi Bamisile, Committee Chairman, said consultations with stakeholders exposed “deep gaps” in the country’s digital finance ecosystem, leaving citizens vulnerable to significant financial and security risks.

“We are concerned about the growing rise in fraud associated with POS operations,” Bamisile said. “Unprofiled agents, cloned terminals, and weak KYC practices continue to expose citizens to preventable dangers.”

The Committee also highlighted the infiltration of unlicensed cryptocurrency services into POS operations. Bamisile warned that such activities, conducted without regulatory approval, pose anti-money laundering risks, potential terrorism financing, data breaches, and misuse of platforms meant for basic payments.

He further revealed cases where fake companies registered with the Corporate Affairs Commission (CAC) used stolen National Identification Numbers (NIN) and Bank Verification Numbers (BVN) to open accounts and launder illicit funds through unverified POS channels. Some fintech firms were also storing sensitive data on foreign servers, undermining regulators’ ability to audit transactions and enforce compliance.

Despite these concerns, Bamisile reassured operators that the investigation aims not to stifle growth but to recommend legislation that harmonizes regulation, strengthens security, protects consumers, and encourages responsible innovation. The Committee will continue consulting regulators, fintech actors, and security agencies before submitting its recommendations to the House.

At the hearing, Paul Okafor, National President of the Association of Digital Payment and POS Operators of Nigeria (ADPPON), described the country’s POS ecosystem as being in a “critical emergency.” He cited the explosive growth from 50,000 POS operators in 2017 to over 2.3 million today, which has outpaced regulatory capacity.

Citing Nigeria Inter-Bank Settlement System (NIBSS) data, Okafor said that POS, digital-payment, and banking channels lost N17.67 billion to fraud in 2023, affecting more than 80,000 customers. Losses soared to N52.26 billion in 2024, with POS channels alone accounting for 26.37% of incidents. Attempted fraud across financial channels surged 338%, while POS fraud spiked 95% in Q4 2024.

He added that criminals increasingly use POS agents as cash-out points for illicit funds, including kidnap ransom payments. In some states, nearly 40% of kidnap ransoms reportedly pass through informal POS channels, transforming the issue from a fintech problem into a national security threat.

Okafor urged the Committee to push the Central Bank of Nigeria (CBN) to implement systemic reforms, warning that inaction could erode financial inclusion, destroy public trust, and destabilize the nation’s payment ecosystem.

He recommended three immediate measures:

- Mandatory Nigeria Police Force–NCCC Cybercrime Clearance Certificates for all POS operators.

- Compulsory CAC registration for every POS business to ensure traceability.

- Mandatory membership of recognized trade associations to enforce discipline, training, and self-regulation.

Okafor noted that these measures reflect global best practices in countries such as India, Kenya, Brazil, South Africa, and the UK, where strict oversight, police vetting, and continuous certification curb fraud.

“No country leaves its financial system open to millions of operators or puts it in the hands of foreigners without strict controls. Nigeria must not be the exception,” he said.

POS services, he added, now reach virtually every household, market, and community across the country, making effective regulation and security safeguards critical to protecting citizens and the financial system.

Leave a Reply