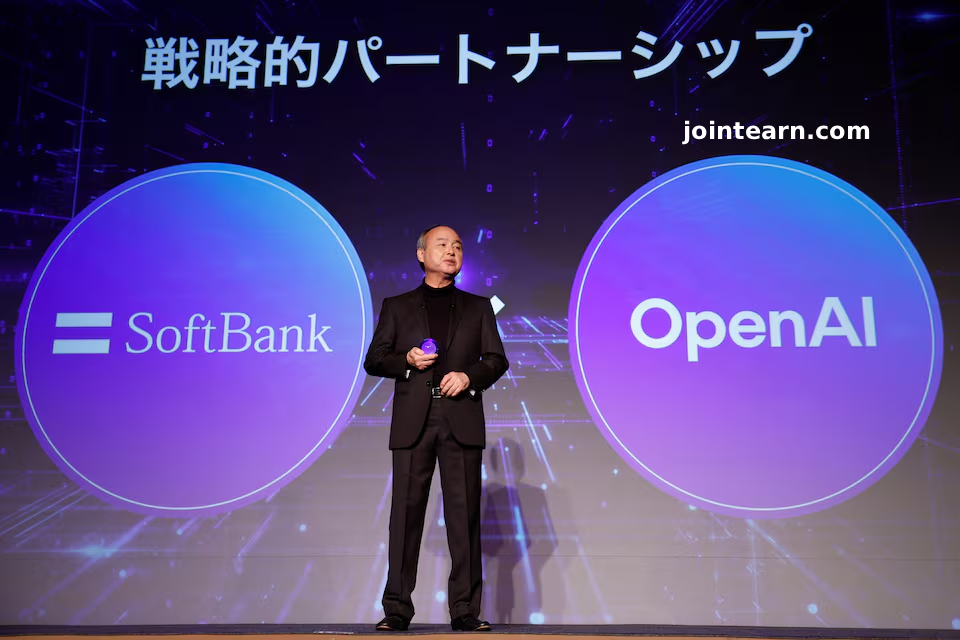

December 20, 2025 – Tokyo, New York, San Francisco – SoftBank Group Corp (9984.T) is racing to fulfill its $22.5 billion funding commitment to OpenAI before the end of 2025, deploying a mix of asset sales, margin loans, and other financial instruments to raise the necessary capital, sources told Reuters. The ambitious move underscores SoftBank CEO Masayoshi Son’s aggressive strategy to strengthen the company’s position in the rapidly expanding artificial intelligence sector.

SoftBank’s Capital-Raising Strategy

To meet the commitment, SoftBank has already:

- Sold its entire $5.8 billion stake in Nvidia

- Offloaded $4.8 billion of its T-Mobile US holdings

- Considered leveraging undrawn margin loans backed by its Arm Holdings shares

- Continued targeted divestments in companies like Didi Global

SoftBank has slowed most other dealmaking at its Vision Fund, requiring CEO approval for any deal exceeding $50 million, signaling a full focus on the OpenAI investment.

Importance of the Funding

The funding is essential for OpenAI’s AI data center expansion, as the company seeks to maintain its competitive edge amid rising rivalry from Google’s AI initiatives. OpenAI recently transitioned to a for-profit model, a condition required for the remaining funds from SoftBank.

The investment is part of the Stargate initiative, a $500 billion plan to build AI data centers across the U.S., supporting the government’s push to maintain leadership in artificial intelligence technology.

SoftBank’s Financial Firepower

SoftBank has multiple capital sources to tap, including:

- Undrawn margin loans against Arm shares, with $11.5 billion in total capacity

- Parent-level cash reserves of 4.2 trillion yen ($27.16 billion)

- Remaining T-Mobile US holdings worth roughly $11 billion

The conglomerate also continues to support AI startups such as Sierra AI and Skild AI, demonstrating a broader AI investment strategy.

Market Impact and AI Industry Context

OpenAI’s funding needs have surged with its plans to expand computing capacity to 30 gigawatts at a projected cost of $1.4 trillion. CEO Sam Altman has described the company as entering a “code red” phase, prioritizing improvements to ChatGPT over other product rollouts to compete with Google’s Gemini AI.

SoftBank’s large-scale investment underscores the increasing capital intensity of AI data center development, which requires substantial infrastructure for power, cooling, servers, and chips. Analysts caution that such massive investments raise the risk of an “AI bubble” if returns fail to meet expectations.

Outlook

SoftBank’s $22.5 billion OpenAI commitment highlights the conglomerate’s all-in bet on artificial intelligence and its strategy to remain a dominant player in the global technology landscape. With multiple funding avenues and strategic asset sales, SoftBank aims to deliver the remaining funds by the end of 2025, enabling OpenAI to continue its rapid expansion in AI research and development.

Leave a Reply