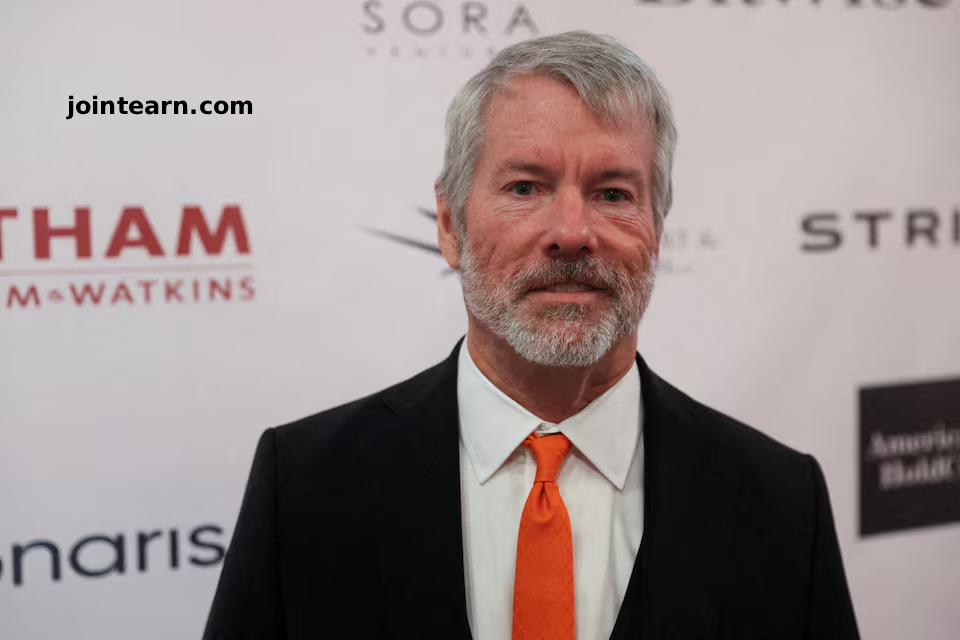

Shares of billionaire Michael Saylor’s Strategy (formerly MicroStrategy) rose on Wednesday after index provider MSCI shelved a proposal to exclude bitcoin-holding companies and other crypto treasury firms from its global benchmarks.

Background: Digital Asset Treasury Companies

These companies, often called DATCOs (Digital Asset Treasury Companies), surged in popularity in 2025. They hold cryptocurrencies such as bitcoin and ether as their main treasury assets, providing investors with a way to gain indirect exposure to crypto through publicly traded shares.

Despite their growth, DATCOs remain volatile due to the sharp price swings of the underlying tokens. Analysts have also debated whether these firms should be treated primarily as holding vehicles or evaluated based on their operational businesses.

MSCI Decision

MSCI had proposed removing DATCOs from its indexes in the fall, arguing that they resemble investment funds, which are typically excluded from its benchmarks. This caused concern among investors that other major index providers might follow suit.

However, MSCI has now postponed the exclusion, stating it will open a broader consultation on the treatment of non-operating companies later in the year. Analysts believe this removes a near-term technical risk for public equities that function as proxies for cryptocurrency exposure.

“While this decision does not resolve longer-term questions around index eligibility of DATCOs, it removes a material near-term technical risk for a subset of public equities that function as effective proxies for bitcoin/crypto exposure,” said Owen Lau, analyst at Clear Street.

Many DATCOs argued they are operating companies developing products, and that MSCI’s proposals unfairly singled out the crypto sector.

Impact on Strategy

Strategy, one of the first DATCOs to start buying bitcoin in 2020, sparked a wave of corporate crypto treasury adoption. Shares of the company surged after the MSCI decision, rising 3.2% in morning trading, although gains were trimmed later as bitcoin prices eased.

The broader U.S. stock market ended higher on Friday, with the Dow closing at another record high, reflecting overall investor optimism despite volatility in the crypto sector.

Key Takeaways

- MSCI has postponed the exclusion of crypto treasury companies from its indexes.

- This decision benefits companies like Strategy, which hold significant cryptocurrency assets.

- DATCOs remain volatile, and their accounting treatment is still under debate.

- MSCI plans a broader consultation on non-operating companies later in 2026.

- Strategy shares rose 3.2% after the announcement.

Leave a Reply