WASHINGTON — Senior U.S. officials sharply criticized China’s sweeping expansion of rare earth export controls on Wednesday, calling the move a direct threat to global supply chains and warning that it could accelerate efforts to decouple the U.S. economy from Beijing.

Washington Warns Beijing to Reverse Course

U.S. Trade Representative Jamieson Greer said during a press conference that the Biden administration views the new restrictions as a “global supply-chain power grab.” He stressed that the United States and its allies would not accept any measure that gives Beijing disproportionate control over the world’s access to critical minerals used in semiconductors, electric vehicles, defense technologies, and renewable energy systems.

“These are drafted, or in draft, so it’s quite real,” Greer said. “Our expectation is that they won’t implement this and that we’ll return to where we were a week ago—with the tariff levels we’ve agreed to and the flow of rare earths continuing.”

Greer and Treasury Secretary Scott Bessent emphasized that Washington did not seek escalation but urged China to reverse its course before the U.S. moves forward with retaliatory tariffs of up to 100% on Chinese imports.

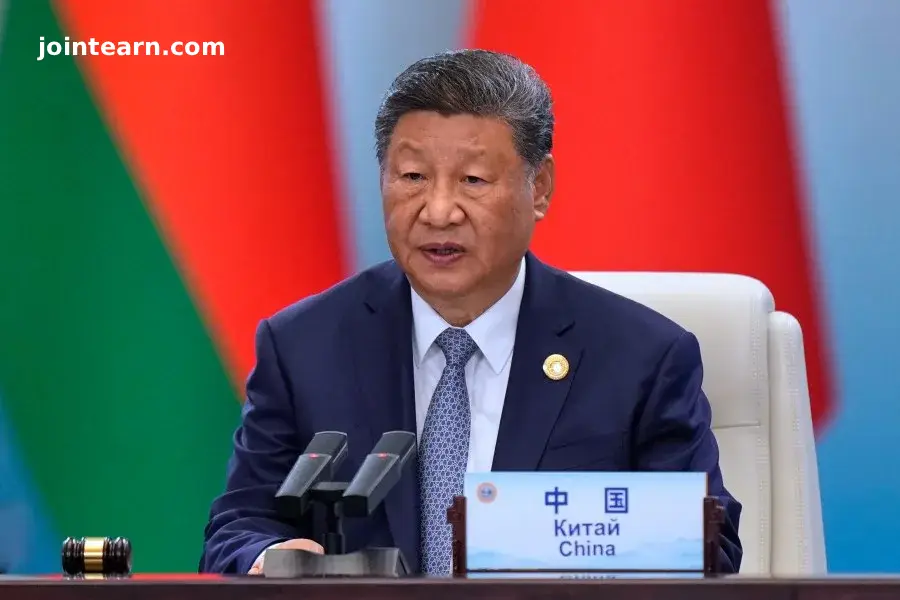

Trump–Xi Meeting Still on the Calendar

As of late Tuesday, President Donald Trump was still planning to meet Chinese President Xi Jinping in South Korea later this month, according to Bessent. The two leaders are expected to discuss the growing rare earths dispute, which has already shaken financial markets and raised fears of a new trade crisis.

Neither Greer nor Bessent confirmed what concessions, if any, might emerge from ongoing negotiations. However, both officials left open the possibility of delaying tariff implementation if China suspended its export restrictions.

“We’re currently on a 90-day tariff roll,” Bessent explained. “It’s possible we could go longer in exchange for a delay, but that will be decided in the coming weeks before the leaders meet in Korea.”

Rare Earth Controls Spark Global Alarm

China’s revised regulatory framework for rare earths—essential minerals that play a crucial role in modern electronics and clean energy—has yet to take effect. Still, Washington sees the move as a strategic escalation intended to reinforce Beijing’s leverage in global technology supply chains.

The dispute coincides with new tit-for-tat port fees between the U.S. and China, marking another front in their ongoing trade confrontation. The developments overshadowed the International Monetary Fund (IMF) and World Bank meetings in Washington this week, where officials had only recently praised a brief U.S.–China trade truce.

The IMF’s latest World Economic Outlook even cited the easing of trade tensions as a key reason for upgrading its global growth forecast. That optimism faded quickly after Beijing’s latest export announcement.

China’s Actions Called “Unreliable”

Bessent cautioned that while the U.S. does not want to economically decouple from China, it will be forced to act if Beijing proves to be an unreliable supplier of rare earths or other critical materials.

He revealed that Chinese officials recently told U.S. automakers that a slowdown in rare earth magnet shipments was “probably related to a holiday,” a statement Washington viewed as dismissive.

“Not only is China fueling Russia’s war in Ukraine,” Bessent said, “but their actions show the risk of depending on them for rare earths—or anything. If China wants to be an unreliable partner, then the world will have to decouple.”

Bessent added that the U.S. is considering additional measures, including new export controls and tariffs on China’s purchases of Russian oil, contingent on support from European allies.

Mounting Pressure and Diplomatic Efforts

Members of the Group of Seven (G7) are expected to meet on the sidelines of the IMF–World Bank summit to discuss coordinated responses to China’s export restrictions.

“While there are substantial actions we can take, we’d rather not,” Bessent said. “I believe China is open to discussion, and I’m optimistic this can still be de-escalated.”

U.S. officials have also presented photographic evidence from Ukrainian intelligence showing that Chinese-made components were used in Russian drones, further complicating Beijing’s position in ongoing diplomatic talks.

“Unleashing Chaos”: Leaked Threat from Chinese Negotiator

Earlier on Wednesday, Bessent told CNBC that China’s export control expansion was not a spontaneous response to U.S. policies but a long-planned strategic move. He cited a senior Chinese trade official, Li Chenggang, who allegedly warned in August that Beijing would “unleash chaos on the global system” if Washington moved ahead with its new port fee increases.

“China clearly intended this all along,” Bessent said. “Their claim that this is retaliatory simply doesn’t add up.”

Li, who serves as China’s chief trade negotiator under Vice Premier He Lifeng, has been a key participant in several rounds of U.S.–China economic talks held across Europe in recent months.

Economic Stakes and the Road Ahead

The United States and China remain locked in a delicate balancing act—neither side wanting full confrontation, yet both unwilling to appear weak. The rare earths dispute underscores the fragility of global interdependence at a time when supply chains are still recovering from pandemic disruptions and ongoing geopolitical shocks.

Analysts warn that an escalation could trigger price surges across industries—from electric vehicles and consumer electronics to defense systems—and force companies to accelerate diversification away from China.

For now, the world’s attention turns to the upcoming Trump–Xi summit, where the future of global trade stability could hang in the balance.

Leave a Reply