As the UK government prepares for the 2025 budget, Finance Minister Rachel Reeves faces critical decisions on taxation and public spending to maintain fiscal discipline and fund welfare initiatives. With bond investors closely monitoring the fiscal strategy, Reeves’ upcoming budget could introduce significant tax changes while staying aligned with her self-imposed fiscal rules.

This article explores the tax options under consideration, their potential impact on UK households, businesses, and the economy, and what voters can expect from the government’s financial strategy.

Income Tax: Threshold Freeze Instead of Rate Hikes

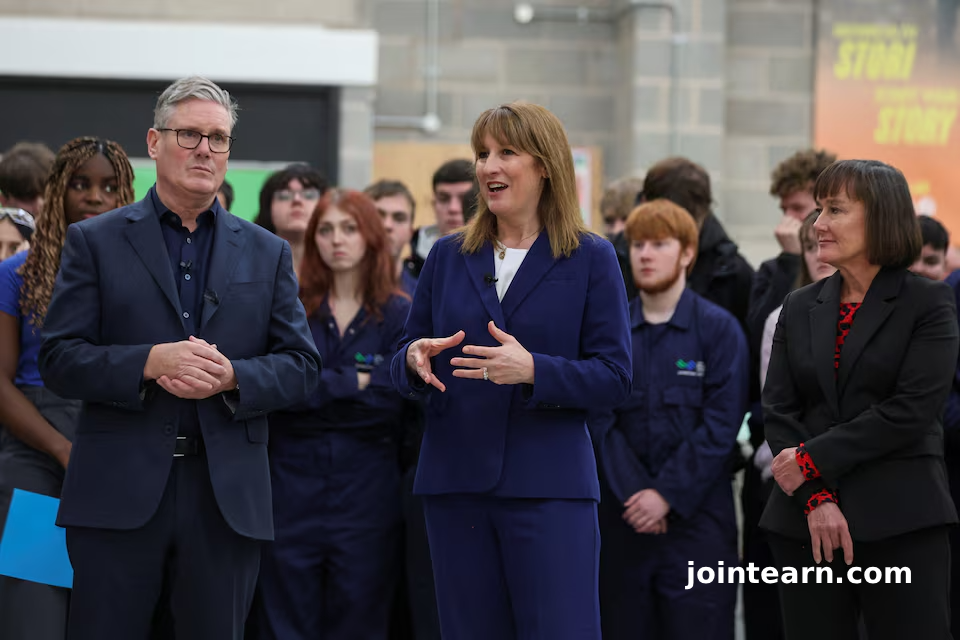

Despite previous assurances from Prime Minister Keir Starmer and Reeves that they would not increase taxes for “working people,” the deteriorating fiscal outlook has put that promise under scrutiny. Reeves recently emphasized that “each of us must do our bit,” hinting at broad tax measures, though officials have confirmed no immediate plans to increase income tax rates.

Instead, Reeves is expected to extend the freeze on income tax thresholds for both basic and higher rates until 2030. Analysts predict this could raise approximately £8 billion annually ($10.5 billion), effectively increasing taxes without altering rates.

Pension Contributions: Limiting Tax-Free Allowances

Changes to pension tax rules may also feature prominently in the budget. Reeves plans to reduce the amount of income employees can divert to pensions without paying a social security levy, potentially generating £3-4 billion annually.

Financial experts, including Legal & General CEO Antonio Simoes, have cautioned that overly aggressive changes could discourage pension savings, particularly amid rising concerns about cash withdrawals and taxation fears.

Property Taxes: Targeting High-Value Homes

The government is reportedly introducing a surcharge on local property taxes for homeowners with properties valued over £2 million, a change from the original £1.5 million threshold. This adjustment will affect fewer homes but could help generate additional revenue from the country’s wealthiest property owners.

VAT: Simplification and Revenue Opportunities

Reeves may simplify the value-added tax (VAT) system by removing lower or zero rates for items such as food and children’s clothing. While this could increase government revenue, it risks adding to the already high inflation rate in the UK.

Experts also suggest that reducing the VAT starting point for businesses could stimulate growth for small firms while improving tax collection efficiency.

Fuel Duty: Ending the Freeze

With fuel duty frozen since 2011, the UK government has forgone a significant revenue source, which currently brings in around £25 billion annually. Reeves may consider ending temporary relief measures introduced in 2022, potentially boosting government income.

Banks and Financial Services: Maintaining Competitiveness

Despite calls from think tanks for higher bank taxes to reclaim interest earnings from reserves held at the Bank of England, Reeves has emphasized maintaining a competitive financial services environment. Reports indicate that banks will likely be spared any immediate tax increases.

Electric Cars: Future Road Charges

In a bid to support sustainable transport while raising funds, the government plans a new electric vehicle tax of 3 pence per mile, equivalent to £250 per year for the average motorist. This measure is expected to take effect in 2028.

“Sin Taxes”: Alcohol, Tobacco, Gambling, and Beyond

Higher taxes on alcohol, tobacco, gambling, vaping, sugary drinks, plastics, and air travel remain possible. While these “sin taxes” may influence consumer behavior, experts warn they could also contribute to inflationary pressures.

Wealthy Individuals: Capital Gains and Exit Tax

Reeves has ruled out a new wealth tax but signaled that higher taxes on affluent individuals will form part of the fiscal strategy. Potential measures include increases in capital gains tax and a proposed exit tax of 20% on wealthy individuals leaving the UK, based on the value of their business assets. While aides have supported this idea, Reeves has expressed caution.

Savings Accounts: Lowering Tax-Free ISA Limits

The government is considering reducing the tax-free limit for cash ISAs from £20,000 to £12,000, encouraging more investment in UK stocks and potentially boosting capital markets.

Legal and Accounting Professionals: Dropped Proposals

Reeves previously considered increasing taxes on partners in limited liability partnerships, commonly used by accountants and lawyers. However, these proposals were reportedly dropped due to feasibility concerns.

Key Takeaways

The 2025 UK budget may not dramatically raise headline income tax rates, but a series of strategic measures, including threshold freezes, property surcharges, pension adjustments, and “sin taxes,” are expected to generate tens of billions in additional revenue. These steps aim to strengthen fiscal stability, fund welfare programs, and provide a buffer against economic shocks.

For investors, households, and businesses, understanding these potential changes will be critical in navigating the coming fiscal year.

Leave a Reply