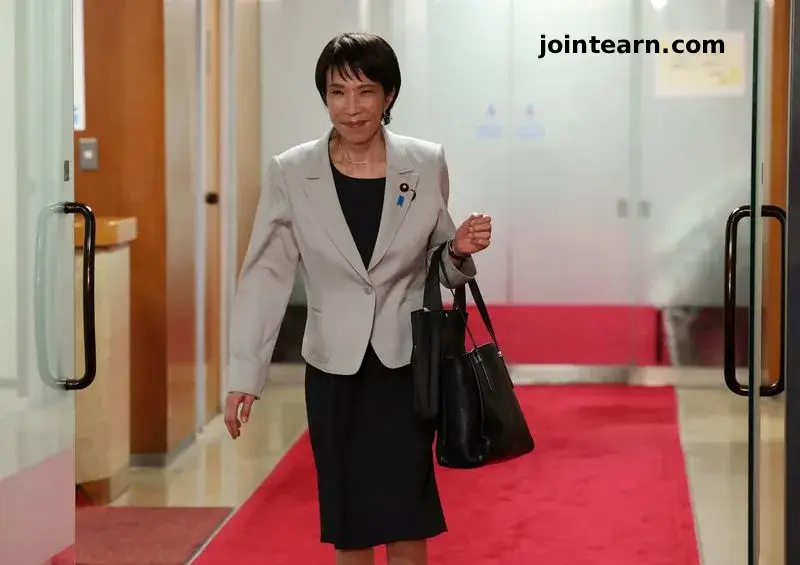

As Sanae Takaichi appears poised to become Japan’s next prime minister, political analysts warn that the fragile alliances keeping her in power could cripple her economic agenda, deepen legislative gridlock, and unsettle financial markets.

Takaichi, the new Liberal Democratic Party (LDP) leader and a close ally of the late Shinzo Abe, is expected to secure parliamentary approval on October 21 to replace outgoing Prime Minister Shigeru Ishiba. But after a week of coalition turmoil, her administration may emerge weaker and more divided than any in recent memory.

Coalition Fractures Threaten Policy Momentum

Ordinarily, winning the LDP leadership guarantees the prime ministership. But Takaichi’s rise hit turbulence when the LDP’s longtime coalition partner, Komeito, abruptly withdrew its support earlier this month.

That rupture has forced her to court new allies—most notably the Japan Innovation Party (Ishin), a right-leaning opposition group that champions deregulation and pension reform.

While such an alliance could help push through stimulus measures and tax cuts, it also risks entangling her policies in partisan conflict and undermining Japan’s ability to address structural challenges such as:

- Chronic labor shortages

- A rapidly aging population

- Persistent supply constraints across industries

“No matter who leads, there’s a high chance of expansive spending packages being passed,” said Keiji Kanda, senior economist at Daiwa Institute of Research.

“But Japan’s deeper policy reforms—like addressing supply bottlenecks and labor issues—are unlikely to make real progress under such political fragmentation.”

A Balancing Act Between Growth and Fiscal Discipline

Takaichi has pledged to prioritize economic revitalization over austerity, signaling an approach closer to Abenomics-style stimulus than fiscal restraint.

However, her weak standing within the LDP—and the influence of powerful veterans such as Taro Aso, the party’s vice president and former finance minister—could restrain large-scale spending plans.

Aso has long argued that Japan’s ballooning debt, now more than 260% of GDP, demands fiscal prudence. Analysts say his faction’s control could curb Takaichi’s ambition for aggressive stimulus.

“The reflationist wing inspired by Shinzo Abe’s policies has lost momentum,” said Noriatsu Tanji, chief bond strategist at Mizuho Securities.

“Takaichi will have to negotiate policy compromises across factions. It will be difficult for her to pursue full-fledged reflationist policies.”

Market Caution: Bond Yields and Investor Sentiment

Financial markets are already reacting to signs of potential fiscal expansion. Japanese government bond (JGB) yields have risen, particularly on long-term maturities, as traders anticipate heavier debt issuance to fund new spending.

The Bank of Japan (BOJ), which has been gradually tapering bond purchases, may be less willing to suppress borrowing costs—leaving Tokyo exposed to higher debt-servicing expenses.

“If bond yields continue to rise, it will pressure the government to moderate its spending ambitions,” said one Tokyo-based fund manager. “Markets may become the ultimate check on Takaichi’s economic populism.”

Ishin’s Deregulatory Focus: A Friction Point

Takaichi’s potential alliance partner, Ishin, takes a sharply different view of Japan’s fiscal priorities. The party favors deregulation and administrative reform over public-sector stimulus, emphasizing self-reliance and reduced government debt.

“If the LDP and Ishin form an alliance, it won’t necessarily mean a surge in fiscal spending,” analysts at Daiwa Securities wrote. “Many of Ishin’s key policies don’t require significant new debt issuance.”

That ideological gap could lead to a fractured policy platform, where Takaichi’s pro-growth agenda clashes with Ishin’s market-oriented approach.

International Pressure: IMF Cautions Tokyo

The International Monetary Fund (IMF) has added its voice to calls for restraint, warning Japan not to pursue blanket stimulus or consumption tax cuts that could deepen fiscal deficits.

“We recognize there are vulnerable households needing support, especially amid high food prices,” said Nada Choueiri, deputy director of the IMF’s Asia and Pacific Department, in an interview with Reuters.

“But any assistance should be targeted and temporary, and Japan must commit to a credible fiscal consolidation plan to reduce its deficit.”

The Road Ahead

Even if Takaichi secures the premiership, she will inherit a deeply fragmented Diet and a divided ruling party. The coming months may determine whether Japan can implement the bold reforms she envisions—or whether political paralysis will once again stall economic renewal.

“Political instability is the last thing Japan’s fragile recovery needs,” said one Tokyo analyst. “If Takaichi can’t build consensus, the opportunity for meaningful reform could slip away.”

🔑 Key Takeaways

- Sanae Takaichi is expected to become Japan’s first female prime minister but faces a fractured legislature.

- The collapse of the LDP–Komeito alliance has forced her to seek support from the Japan Innovation Party (Ishin).

- Policy friction between fiscal stimulus advocates and budget hawks could slow Japan’s recovery.

- Rising bond yields and the IMF’s fiscal warnings limit Takaichi’s room for expansive spending.

- Political gridlock may stall crucial reforms in labor, energy, and industrial policy.

Leave a Reply