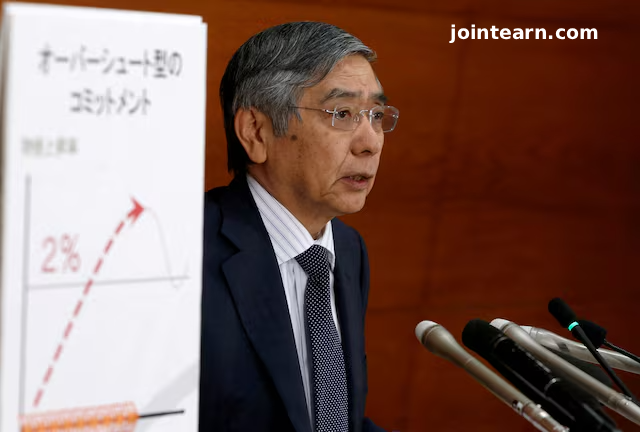

Bank of Japan Governor Haruhiko Kuroda reaffirmed the central bank’s commitment to its ultra-loose monetary policy during a press conference following the BOJ’s latest policy meeting. Despite rising global interest rates, the BOJ kept its short-term rate at -0.1% and maintained its 10-year government bond yield target around 0%.

Kuroda highlighted the economic risks posed by the Ukraine crisis, particularly through surging raw material costs that could temporarily push Japan’s inflation rate to around 2% starting in April. However, he reaffirmed that the BOJ sees this inflation as transitory and tied to external cost pressures rather than domestic demand.

“Rising costs will push up inflation, but they will also weigh on households and corporate profits,” Kuroda stated, emphasizing the need for “patient and powerful monetary easing” to achieve stable, sustainable inflation.

On the weaker yen, Kuroda maintained that a depreciated currency still brings net benefits to Japan’s economy, though he acknowledged the uneven impact across sectors. He also downplayed the idea that interest rate differentials alone were driving recent foreign exchange trends.

Kuroda dismissed concerns of stagflation in Japan, contrasting the country’s economic outlook with that of the U.S. and Europe. He also pointed to positive outcomes from recent wage negotiations but noted the need for close monitoring as geopolitical uncertainties persist.

While Japan’s inflation may reach the BOJ’s 2% target in the near term, Kuroda stressed that the central bank will not tighten monetary policy until inflation expectations rise more broadly and wage growth becomes more robust.

“Price rises driven mostly by cost-push inflation are temporary,” he said, adding that medium- and long-term inflation expectations remain stable.

The BOJ continues to track developments in the global economy and domestic wage growth as it weighs its strategy for guiding Japan safely out of its prolonged low-growth, low-inflation period.

Leave a Reply