Category: finance

-

U.S. Job Growth Slows in December as Unemployment Rate Dips to 4.4%

U.S. employment growth stalled in December, with nonfarm payrolls increasing by just 50,000 jobs, signaling a labor market that is growing at a very slow pace. Despite the slowdown, the unemployment rate fell to 4.4%, down from 4.5% in November, suggesting the job market is holding steady even as hiring remains subdued. Economists see these

-

London’s FTSE 100 Hits Record Highs on Glencore Surge and U.S. Jobs Data

London’s FTSE 100 index closed at a record high on Friday, boosted by positive investor sentiment following U.S. employment data and a sharp rally in Glencore shares amid potential merger talks. The milestone reflects a growing optimism in global markets, with energy stocks and mining companies leading the charge. FTSE 100 Reaches All-Time Closing High

-

Euro Zone Economy Shows Resilience in 2025 with Strong Retail and Industrial Growth

The Eurozone economy concluded 2025 on a surprisingly resilient note, buoyed by stronger-than-expected retail sales and a rebound in German industrial output. Despite ongoing global trade uncertainties and modest growth forecasts, recent economic data suggest the region is adjusting well to challenges, offering cautious optimism for 2026. Eurozone Retail Sales Exceed Expectations Eurostat data revealed

-

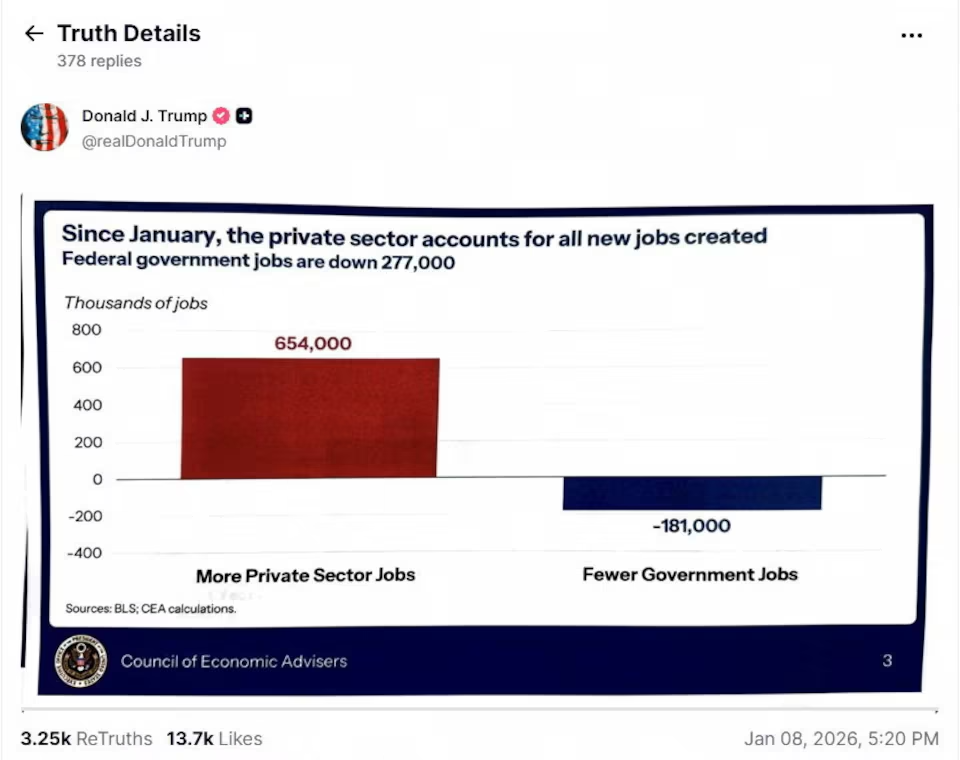

Trump Posts Unreleased U.S. Jobs Data on Social Media

On January 9, 2026, U.S. President Donald Trump posted a chart on his social media platform, Truth Social, showing job-market data that had not yet been officially released. The data included: The figures were later published in the December jobs report by the U.S. Labor Department. The White House described the post as an “inadvertent”

-

Venezuelan Bondholders Await Approval to Begin Debt Restructuring Talks

A key group of Venezuelan bondholders has signaled its readiness to start debt restructuring negotiations once formal authorization is granted. The announcement follows the recent U.S. capture of President Nicolás Maduro, which has driven Venezuelan government bonds higher and renewed hopes for one of the largest and most complex sovereign debt restructurings in recent history.

-

Federal Reserve Appoints Chairs and Vice Chairs for 12 Regional Banks in 2026

The Federal Reserve Board announced the appointment of chairs and vice chairs for its 12 regional banks for 2026, highlighting a mix of corporate leaders, small business executives, and nonprofit heads who will help guide U.S. monetary policy decisions. Among the appointments, Lal Karsanbhai, CEO of Emerson Electric Co., will serve as chair of the

-

U.S. Household Wealth Hits Record $181.6 Trillion in Q3 2025, Fed Data Shows

U.S. household wealth reached an all-time high of $181.6 trillion in the third quarter of 2025, fueled by a surge in stock market investments, particularly in artificial intelligence (AI) companies, and continued gains in home values, according to new data released by the Federal Reserve on Friday. This represents a $6 trillion increase from the

-

Argentina Fully Repays U.S. Currency Swap Line, Signaling Stronger Financial Position

Argentina has fully repaid the United States for a currency swap arrangement it used in late 2025 to stabilize its economy, U.S. Treasury Secretary Scott Bessent and Argentina’s central bank confirmed on Friday. The repayment marks the successful conclusion of a swap line agreement originally intended to protect the Argentine peso and support financial stability

-

Italy Open to Selling Remaining Monte dei Paschi Stake, PM Meloni Says No Rush

Italy’s government is open to selling its remaining stake in bailed-out bank Monte dei Paschi di Siena (MPS) but sees no immediate urgency, Prime Minister Giorgia Meloni announced on Friday. The remarks came during her annual New Year’s press conference in Rome, highlighting Italy’s cautious approach to divesting from the historic lender. Government’s Shareholding in

-

Italy to Allocate 1 Billion Euros to Reduce Energy Prices, PM Meloni Announces

Italy plans to spend approximately 1 billion euros ($1.16 billion) to curb rising energy bills for households and businesses, Prime Minister Giorgia Meloni announced on Friday. The move is part of broader efforts to stimulate economic growth and maintain energy security in 2026. Government Action to Stabilize Energy Costs Speaking at her annual New Year’s

Recent Posts

- Real Madrid Top Earners Globally as Liverpool Surpasses Manchester United

- Andoni Iraola’s Future at Bournemouth Remains Uncertain Amid Transfer and Contract Questions

- “Over 5,000 Men Want to Marry Me” — Nkechi Blessing Cries Out Over DM Flood

- Fela’s Daughter Fires Back at Wizkid Amid Seun Kuti Feud

- Chioma Sparks Reactions With Humorous Response to Unwanted DMs

Hi, this is a comment. To get started with moderating, editing, and deleting comments, please visit the Comments screen in…