Category: finance

-

ECB’s Schnabel: Fresh Bond Purchases Still a Long Way Off

European Central Bank (ECB) board member Isabel Schnabel has indicated that the ECB remains distant from restarting large-scale bond purchases aimed at boosting liquidity in the banking system. Speaking on Thursday, Schnabel emphasized that the central bank must first reduce the substantial portfolio of bonds accumulated during years of ultra-loose monetary policy. Between 2015 and

-

Norway Central Bank Holds Interest Rates at 4.0%, Signals Possible Cuts in 2026

Key Points OSLO, Nov 6 (Reuters) — Norway’s central bank, Norges Bank, held its benchmark interest rate at 4.0% on Thursday, in line with analysts’ expectations, as it continued efforts to rein in inflation. The bank also reiterated its outlook for a potential rate cut sometime in 2026. “The job of tackling inflation has not

-

Indian Rupee to Trade in Tight Range as RBI Intervenes to Curb Volatility – Reuters Poll

Key Highlights: BENGALURU, Nov 6 (Reuters) — The Indian rupee is expected to remain tightly range-bound against the U.S. dollar in the coming months as the Reserve Bank of India (RBI) resumes its familiar strategy of currency market intervention to prevent excessive volatility, according to a Reuters poll of FX analysts. Despite brief speculation earlier

-

Motion Picture Association Demands Meta Remove PG-13 Label from Instagram Teen Filters

The Motion Picture Association (MPA) has issued a cease-and-desist letter to Meta Platforms over the company’s recent use of PG-13 branded content filters on Instagram, intended to protect users under 18. The MPA claims Meta’s use of the PG-13 movie rating system—a registered certification mark—is “literally false and highly misleading,” asserting that Instagram’s automated content

-

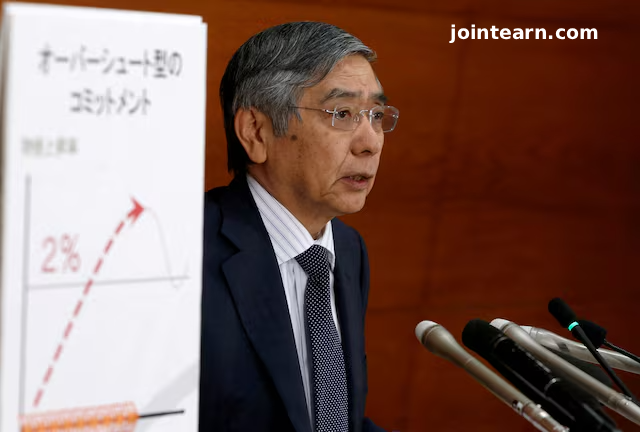

BOJ Governor Kuroda Signals Continued Monetary Easing Amid Ukraine Crisis and Inflation Concerns

Bank of Japan Governor Haruhiko Kuroda reaffirmed the central bank’s commitment to its ultra-loose monetary policy during a press conference following the BOJ’s latest policy meeting. Despite rising global interest rates, the BOJ kept its short-term rate at -0.1% and maintained its 10-year government bond yield target around 0%. Kuroda highlighted the economic risks posed

-

ExxonMobil Enters Greek Offshore Gas Exploration with New Block 2 Deal

U.S. energy giant ExxonMobil has partnered with Energean and Helleniq Energy in a major new venture to explore natural gas reserves offshore Greece. The agreement grants ExxonMobil a 60% stake in the exploration project located in Block 2, off western Greece, with plans to become the operator if initial drilling yields positive results. Speaking at

-

Portugal’s EDP Announces €12 Billion Investment Plan for 2026-2028, Prioritizes U.S. Renewable Expansion

EDP (Energias de Portugal), the country’s largest utility and a leading player in the global renewable energy sector, has unveiled a strategic investment plan of €12 billion ($13.99 billion) for 2026-2028. The majority of this investment will support renewable energy growth, with a strong focus on expanding capacity in the United States, the company announced

-

UK Bank Stocks Climb as Budget Tax Threat Fades, Reports Say

UK bank stocks rose on Thursday following reports that Chancellor Rachel Reeves may exclude them from a planned budget tax hike. The Financial Times reported that the upcoming budget could spare Britain’s financial institutions from additional tax burdens, boosting investor confidence. The FTSE 350 Banks Index surged 1.3% in early trading, outperforming the broadly flat

-

European Stocks Dip as Investors React to Mixed Earnings; Legrand Shares Plummet 11%

European equity markets edged lower on Thursday, extending a week marked by volatility and cautious sentiment. Tech-linked stocks led the downturn as disappointing results from French electrical equipment maker Legrand intensified ongoing concerns over lofty valuations. STOXX 600 Edges Lower Amid Earnings Season Volatility The pan-European STOXX 600 index (.STOXX) slipped 0.2% to 570.98 points

-

Grasim Industries Shares Plunge Over 6% After Birla Opus CEO Exit Sparks Growth Concerns

Shares of Grasim Industries Ltd (GRAS.NS) plunged as much as 6.5% on Thursday—marking the steepest intraday decline in more than three years—after the sudden exit of the CEO of its newly launched paints division triggered concerns about long-term growth. Leadership Change Drives Stock Selloff Rakshit Hargave, who served as CEO of Grasim’s paints arm, Birla

Recent Posts

- Real Madrid Top Earners Globally as Liverpool Surpasses Manchester United

- Andoni Iraola’s Future at Bournemouth Remains Uncertain Amid Transfer and Contract Questions

- “Over 5,000 Men Want to Marry Me” — Nkechi Blessing Cries Out Over DM Flood

- Fela’s Daughter Fires Back at Wizkid Amid Seun Kuti Feud

- Chioma Sparks Reactions With Humorous Response to Unwanted DMs

Hi, this is a comment. To get started with moderating, editing, and deleting comments, please visit the Comments screen in…