Category: finance

-

South Korea’s President Lee Jae Myung Seeks Strategic Cooperative Partnership With China

South Korean President Lee Jae Myung emphasized the importance of strengthening bilateral ties with China during a high-level summit with President Xi Jinping in Beijing on Monday. The meeting was described as a pivotal opportunity to fully restore South Korea-China relations and lay the groundwork for a durable strategic partnership. Summit Focuses on Irreversible Strategic

-

Italy and Pirelli Explore Options to End Chinese State-Owned Sinochem’s Stake Amid U.S. Pressure

Italy and tyremaker Pirelli are reportedly exploring strategies to reduce or end the involvement of Chinese state-owned Sinochem Corporation in the Milan-based company, according to a report by the Financial Times. This development comes amid growing U.S. pressure on Chinese investment in automotive and technology sectors. Sinochem’s Influence and Stake in Pirelli Sinochem currently holds

-

China and South Korea Agree to Strengthen Cultural Exchanges Following Summit in Beijing

China and South Korea have agreed to strengthen cultural exchanges in an orderly and gradual manner, following a high-level summit in Beijing aimed at restoring and enhancing bilateral relations between the neighboring countries. Leaders Meet to Revive Bilateral Ties South Korean President Lee Jae Myung met with Chinese President Xi Jinping on Monday in Beijing,

-

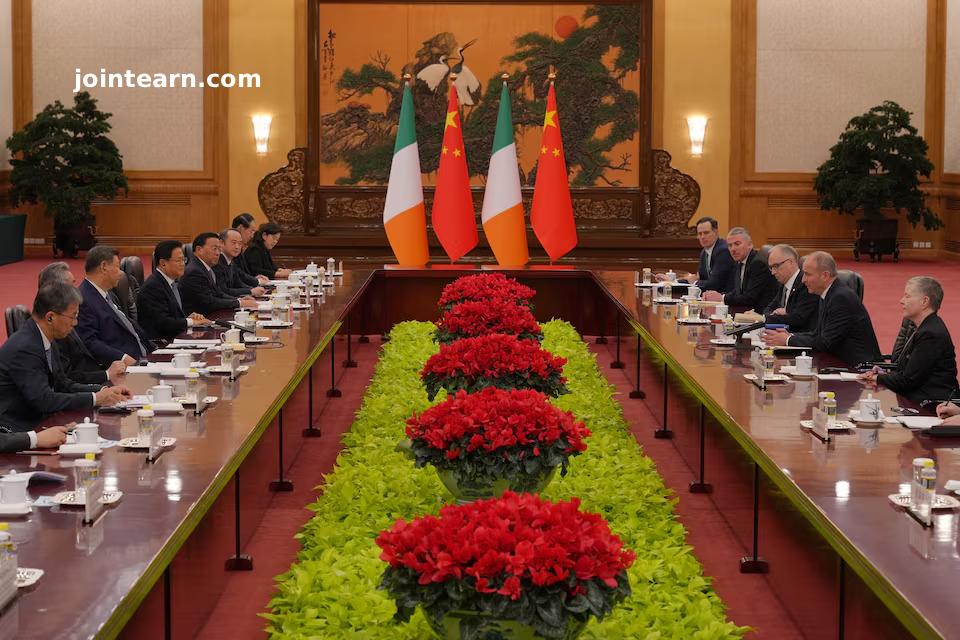

Irish Prime Minister Micheál Martin Seeks Deeper Trade Talks With China Amid EU-China Tensions

Irish Prime Minister Micheál Martin is pursuing more in-depth trade discussions with China’s top officials during his visit to Beijing, aiming to strengthen strategic economic ties with the world’s second-largest economy. The talks come amid strained relations between China and the European Union, highlighting Ireland’s efforts to carve a unique role in the global trade

-

Pop Mart Expands Global Supply Chain Amid Surging Demand for Labubu Collectibles

Chinese toy giant Pop Mart is taking major steps to expand its global presence by adding new manufacturing facilities in Mexico, Cambodia, and Indonesia. This move is part of the company’s broader strategy to meet skyrocketing international demand for its popular Labubu blind-box collectibles and other signature art toys. Pop Mart’s Strategic Supply Chain Expansion

-

Tesla Loses Global EV Crown to China’s BYD Amid Political Controversies and End of US Tax Breaks

Tesla has lost its position as the world’s top-selling electric vehicle (EV) manufacturer to Chinese automaker BYD, marking a significant shift in the global EV market. In 2025, Tesla sold 1.64 million vehicles, compared with BYD’s 2.26 million units, representing a 9 percent year-on-year decline for the California-based company. The loss of Tesla’s leadership comes

-

Dow Climbs on First Day of 2026 Despite Absence of Santa Claus Rally

U.S. stock markets kicked off 2026 with modest gains, as the Dow Jones Industrial Average and S&P 500 snapped a four-day losing streak. The Dow rose 319.10 points (0.66%) to 48,382.39, while the S&P 500 gained 12.97 points (0.19%) to 6,858.47. The Nasdaq Composite remained largely flat, closing at 23,235.63. Chipmakers Nvidia and Intel, along

-

Berkshire Hathaway Enters Post-Buffett Era as Shares Slip Slightly

Berkshire Hathaway Inc. quietly entered the post-Buffett era on Friday as shares drifted lower, following Warren Buffett’s historic decision to hand over the CEO role to longtime lieutenant Greg Abel. After six decades as the conglomerate’s chief architect, Buffett’s exit marks a major milestone in the company’s history. Leadership Transition Greg Abel, 63, now oversees

-

Global Equity Funds See Strong Inflows in Final Week of 2025 Amid AI Rally

Global equity funds closed 2025 on a strong note, with investors showing renewed confidence amid AI-driven market gains and a robust corporate earnings outlook. According to LSEG Lipper data, global equity funds recorded $26.54 billion in net inflows during the last week of the year, following approximately $37.05 billion the previous week. Market Performance and

-

U.S. Equity Funds End 2025 on Strong Note Amid AI-Driven Rally

U.S. equity funds closed 2025 with robust inflows for a second consecutive week, reflecting investor optimism following a year of AI-driven stock market gains and strong expectations for corporate earnings growth in 2026. Fund Flows and Market Performance According to LSEG Lipper data, U.S. equity funds attracted approximately $16.89 billion in net inflows during the

Recent Posts

- Real Madrid Top Earners Globally as Liverpool Surpasses Manchester United

- Andoni Iraola’s Future at Bournemouth Remains Uncertain Amid Transfer and Contract Questions

- “Over 5,000 Men Want to Marry Me” — Nkechi Blessing Cries Out Over DM Flood

- Fela’s Daughter Fires Back at Wizkid Amid Seun Kuti Feud

- Chioma Sparks Reactions With Humorous Response to Unwanted DMs

Hi, this is a comment. To get started with moderating, editing, and deleting comments, please visit the Comments screen in…